Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific markets rallied huge. China and Hong Kong moved up over 3%, India, Japan and South Korea more than 2%, Indonesia and Taiwan more than 1%. Europe is currently up across-the-board. Belgium and Greece are up more than 2%, Austria, France, Germany, Amsterdam, Stockholm and the Czech Republic more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are down.

China announced the approved construction of 25 subway lines and 13 highway projects – these are being viewed as stimulus.

Here are the numbers…

unemployment rate: 8.1% (it was 8.3% last month) – the drop was due to a smaller labor force, not an increase in jobs.

nonfarm payrolls: up 96K (125K was expected)

private payrolls: (I will post these when I get the number)

average workweek: 34.2 hours (a 0.2 drop)

hourly earnings: $23.52 (same as last month)

On the news, S&P futures initiallly dropped a couple points but has since recovered.

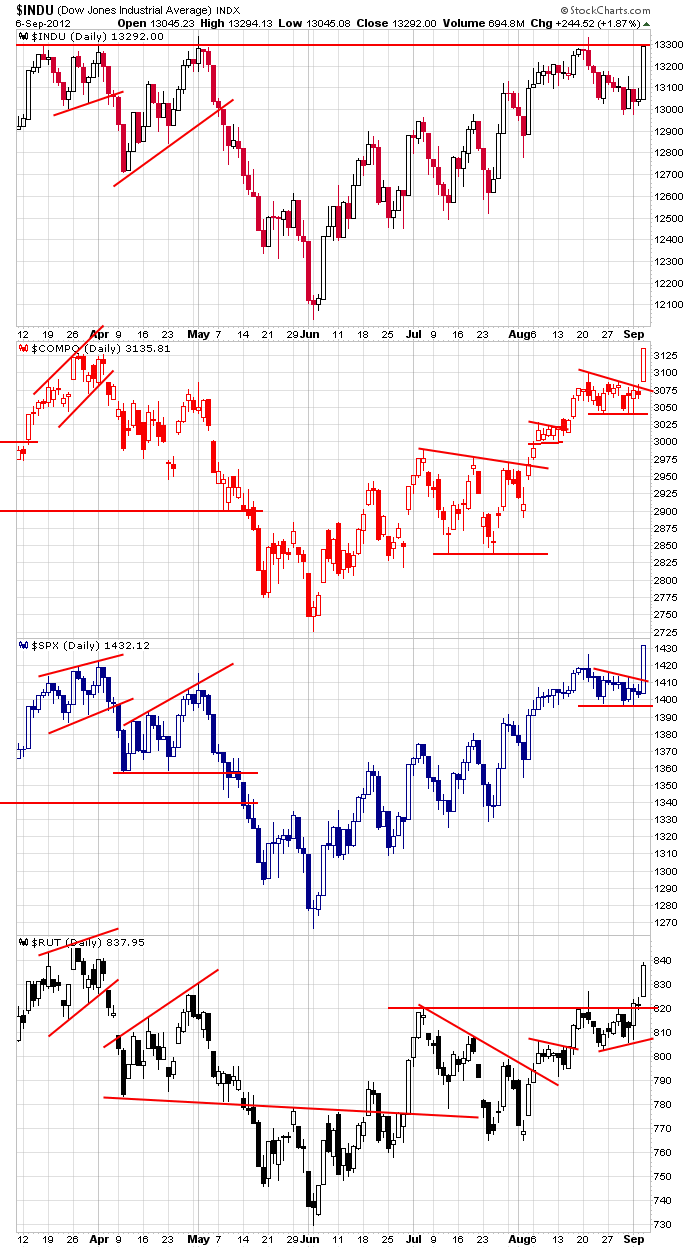

Here are the daily charts…they look great. Yesterday, the Dow put in its biggest day since the June bottom and is now back at resistance. The Nas and S&P gapped up and rallied hard and closed at new multi year highs. The Russell, which broke out two days ago, has more work to do to take out its 2012 high, but after that isn’t far from an all-time high. Super bullish, across-the-board action.

LULU raised full year guidance…the stock is up 2 bucks before the open.

Apple is launching a streaming radio service like Pandora, which is down 12% in premarket trading.

Glencore raised its bid for Xstrata from $34B to $37B.

INTC warned Q3 revenue will come in below previous estimates. The stock is down 2%.

SWHC is up 21% in premarket trading – they reported strong growth in profit, revenue and margins.

ADNC is down almost 60% – they said Apple is unlikely to use its processor intellectual property in its next generation smartphone.

BRC is down 13% – earnings related.

MFRM is down 11% – earnings related.

The market feels strong enough to absorb the so-so jobs report, and I believe absent something totally unforeseen, the market’s uptrend will continue. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 7)”

Leave a Reply

You must be logged in to post a comment.

The rally may keep moving, but its due to expected FED easing. Riding the indexes is likely the easy way to invest in this type of market. Individual stocks appear vulnerable to surpise and shock.

Bonds down, no growth or demand for money expected by the swells.

imo the euro has peaked at 1.28 for this corective leg

if so the equities world wide also have toped at todays high

this should be confirmed by insto selling next week

todays weekly opts ex has been important as there were to many bullybears