Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed. None of the indexes moved more than 1%. Europe is currently mixed. Greece is up 4.1%; the Czech Republic is down 1.3%. Otherwise it’s been a pretty quiet day. Futures here in the States point towards a down open for the cash market.

The dollar is up a small amount. Oil is down, copper up. Gold and silver are down.

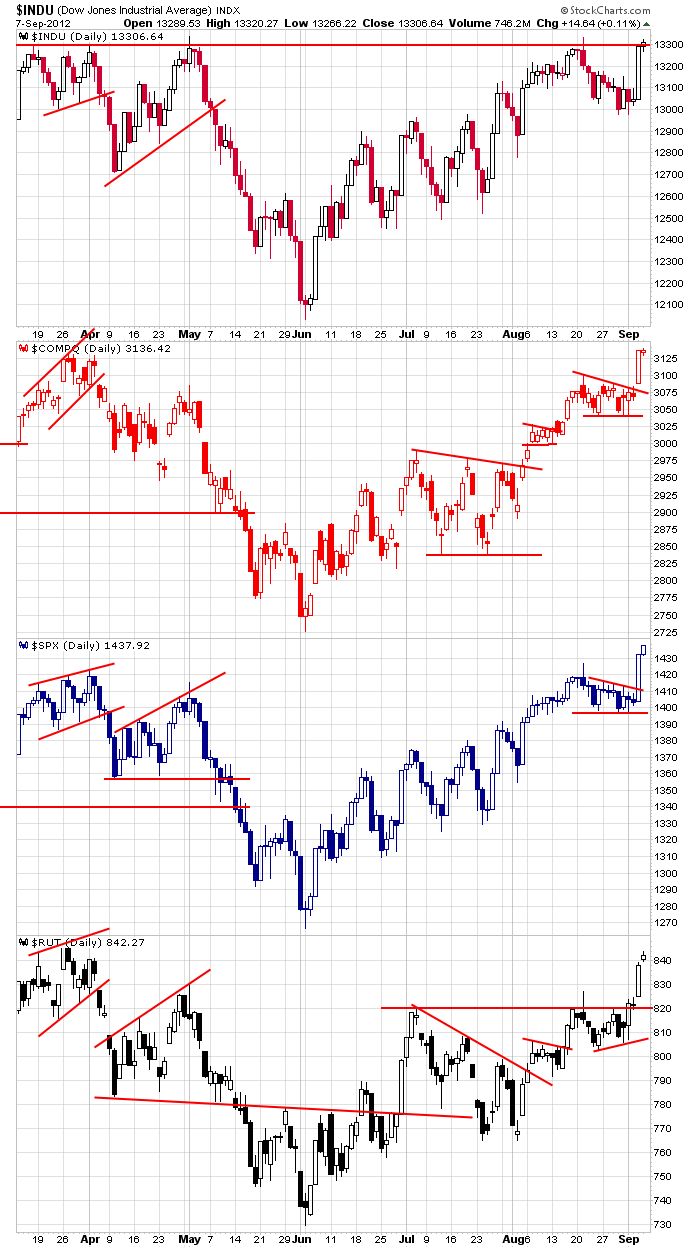

The market broke out in a big way last week. It had been quiet for several weeks (it was super wound up, lots of pent up energy) and then busted out when the ECB announced plans to buy government bonds. Here are the daily charts. The Dow is near a previous high. The Nas and S&P are at multi-year highs. The Russell is not yet at a 52-week high, but it’s closest to an all-time high.

From a technical standpoint, things look good…although I would not say the bulls can rest yet. The Dow and Russell still have to take out previous highs, and then we need follow through. Failure to get some separation would be cause for concern…concern we may get false breakouts. So far, so good, but there’s work to do. And I’m a little concerned there’s too much bullishness out there. Everyone seems set on a fall rally.

The big event this week is the FOMC meeting Thursday. I’m hearing lots of chatter the Fed will announce QE3. From an outsider’s perspective, this is nuts. Why would the Fed do QE3 when market is doing so well?

If it’s true the recent strength is in anticipation of more QE, the market could suffer a stiff move down when it’s officially announced (sell the news), and if there is no more QE, look out below!

The Treasury Department is will $18B in AIG stock. Now they’ll be less than a 20% stack holder in the company.

More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 10)”

Leave a Reply

You must be logged in to post a comment.

the dax/ndx led

is time ripe for a reversal

the quad witches have a special brew