I’m two days late with this report. Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

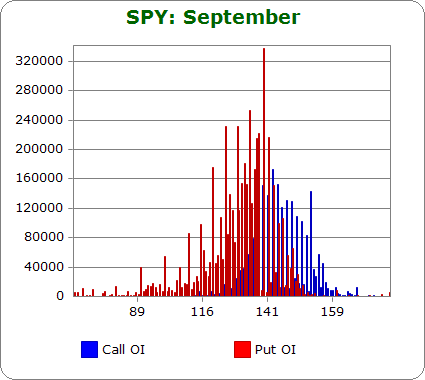

SPY (closed 146.70)

Puts out-number calls 2.1-to-1.0 – about the same as last month.

Call OI is highest between 140-150, and the biggest spike is at 142.

Put OI is highest between 120-142, and the biggest spike is at 140.

There’s overlap between 140-142, so as long at SPY can close somewhere in the middle of this range, most calls and puts will expire worthless. And as a bonus, both of the biggest spikes would expire worthless. Today’s close was at 146.70, much higher than the max pain range. Put buyers are set to lose everything (again), but there will be some call buyers who make money this month. Kudos to them. The market would have to tank for both sides to feel a lot of pain. .

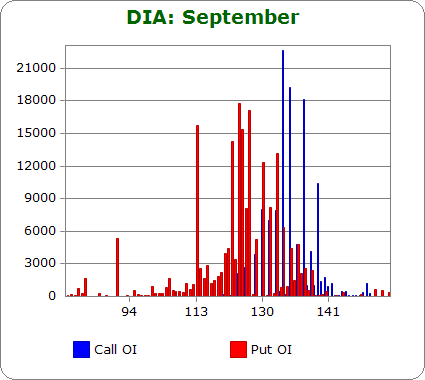

DIA (closed 135.73)

Puts out-number calls 1.4-to-1.0 – more bearish than last month.

Call OI is highest between 133-136.

Put OI is highest at 113 and between 123-132.

There’s an obvious split between the highest open-interest call and put spikes. If DIA can close at or near 132/133, most calls and puts will expire worthless. But DIA closed today at 135.73, well above the needed level. As of now the bears will lose again, and this month, the bulls will make a few bucks on those lower strike calls. The market would have to tank for both sides to feel a lot of pain.

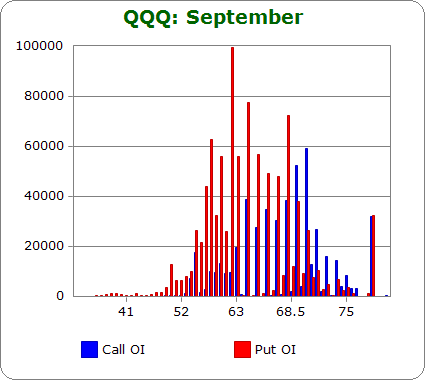

QQQ (closed 70.40)

Puts out-number calls 1.7-to-1.0 – about the same as last month.

Call OI is highest between 64-70.

Put OI is highest between 58-68, and that big spike is at 62.

There’s lots of overlap here – a 5 point range (64-68). But other than the put spike at 68, the highest open-interest call spikes are above the overlap range, and the highest open-interst put spikes are below the range. A close somewhere above the middle of the range would cause the most pain – because put OI is heavier than call OI. Let’s call it ~ 67. Today’s close was at 70.40, well above the needed level. Call buyers will make some money this month; put buyers will lose again. The market would have to sell off hard the next two days for both sides to feel a lot of pain.

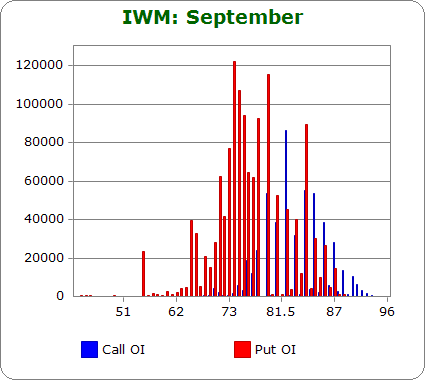

IWM (closed 85.57)

Puts out-number calls 2.7-to-1.0 – more bearish than last month.

Call OI is highest between 80-86.

Put OI is highest between 70-84.

The overlap range is several points (80-84), but the bulk of the put OI lies below the range. A close near 82 would close most contracts worthless. But today’s close was at 85.57, well above the desired level. The bulls will make some money; the bears will lose again. That is unless the market sells off hard the next two days.

Overall Conclusion: The bears once again bet big the market would fall part, and not only will they lose big time, to add insult to injury, the bulls will make a few bucks because in all cases the ETFs above are a few points above their max pain levels. The market would have to sell of pretty hard the next two days for max pain on both sides to be reached.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

Thanks Jason,

and quadwitching should give good volume

Great work.

This market has to move. My models tell me a big one. Never short a dull market but i don’t see a huge upside here.