Good morning. Happy Thursday.

The Asian/Pacific markets closed down across the board. China dropped 2.1%, and Hong Kong, Malaysia and Japan dropped more than 1%. Europe is currently mostly down, but only Austria (down 1.5%) is down more than 1%. Greece is up 2.7%. Futures here in the States point towards a gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

ADBE missed on earnings yesterday, but the stock is up in premarket trading today.

NKE announced an $8B share buyback program.

BAC is speeding up workforce cuts so the cuts can be completed by the end of the year.

NSC warned its Q3 numbers will be below its 2011 Q3 numbers. The stock is down 6% before the open.

AIR reported earnings and raised its full-year profit target. The stock is up 7%.

APOG reported earnings and increased its profit outlook for fiscal 2013. The stock is up 20% on the news.

MLHR miss on earnings.

CLC reported earnings and then reduced its full-year forecast.

NOC is increasing its share buyback to $2B.

CQP is selling 8 million common shares up for sale in a secondary offering. The stock is down almost 6%.

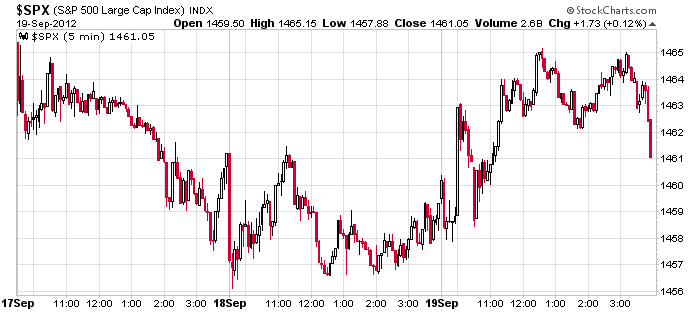

We entered this week with the risk/reward for new trades not being very good. Most good set ups had already broken out (many rallied to hit their targets), and the ones left had lower odds of “working” because the overall market wasn’t going to support the moves. Managing what we had rather than aggressively entering new trades was wise. Here’s the 3-day, 5-min chart. The index has traded in a 10-point range. That’s not bad. Since we were looking for a pause or mini correction, getting slow movement is exactly what we wanted. Today’s open will be near the botton of the range.

Don’t push it. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 20)”

Leave a Reply

You must be logged in to post a comment.

THE First Time Claims number is still too high. The commodities are down suggesting that the recovery is very much in doubt – worldwide. Defensive plays are now on the table. We will be short the major indexes by mid day. Suspect that bonds are not finished just yet. The recession looks like it is going nowhere.

now thats my type of chart

add some real time indicators and take some scalps

daytrading is big bets,big margins,big gains/limited loses with stops

or range trade it with smaller bets

the quad witches will rule for next few days

and some talk with rebalancing of indexes trouble

a flash crash would be nice and we have had the hindenberg indicator fired already