Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed down across the board. India, Indonesia, Singapore and Taiwan dropped 1% or more. China, which was closed all last week, dropped 0.6%. Europe is currently mostly down. France, Germany and Stockholm are down 0.9% or more. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

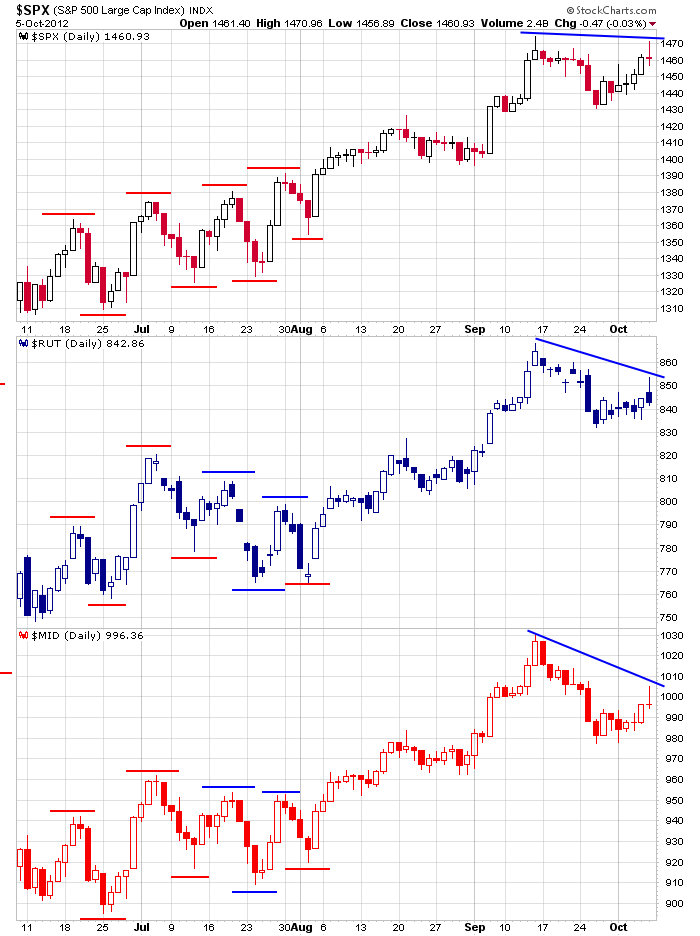

I don’t have anything major to add to the comments I made over the weekend in the weekly report when I essentially said I don’t entirely trust last week’s move yet. The small and mid caps are lagging (never a good thing), and a few indicators still need time to cycle away from their recent extreme levels. Overall the intermediate term trend is up and in good shape, but the near term remains unclear. Trade, but be conservative. Trade the best patterns only and don’t let a decent move go against you.

The World Bank cut its growth forecasts for East Asia and said the slowdown in China could worsen and last longer than many analysts have forecast.

AFFX is down 10% before the open…it warned its revenue would come in light.

CGI said profit from their latest quarter will come in higher than analysts currently expect.

GDOT is down almost 20%.

TPCG is mulling over an acquisition offer from IOSP. TPCG is up 11%.

EXAS is up 7.5% premarket.

VRNG continues its amazing climb. It’s up better than 10%.

UNH is acquiring 90% of Amil Participacoes SA for $4.3B.

ASBB is buying back up to 5% of its common stock.

From a technical standpoint my biggest concern heading into this new week is the under-performance of the small and mid caps. Here’s a chart comparing them to the S&P large caps. The SPX nearly matched it September high; the Russell small caps and S&P mid caps didn’t come close. A divergence in the near term isn’t a big deal, but when it persists and grows, it’s a big concern. It this continues, the upside is very limited.

More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers