Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. China rallied 2%, and Japan dropped 1.1%. Nothing else moved much. Europe is currently mixed, but none of the indexes moved much from their unchanged levels. Futures here in the States point towards an up open for the cash market.

The dollar is up slightly. Oil and copper are up. Gold and silver are mixed and flat.

Radio Shack (RSH) has been upgraded. The stock is up 12.5% in premarket trading. Hmmm. The stock is near the top of my “won’t be around much longer” list.

Owens Corning (OC) is down almost 3% before the open. They said weakness in their roofing materials business will cause them to miss revenue expectations.

JNJ was cut to a sell by Goldman. LLY was upped to neutral.

Spectrum Brands (SPB) is acquiring the hardware & home improvement business of Stanley Black & Decker (SWK).

VDSI cut its full-year guidance.

Apollo Commercial Real Estate (ARI) is selling 7 million shares in a secondary offering.

DEST raised its earnings estimates for Q4.

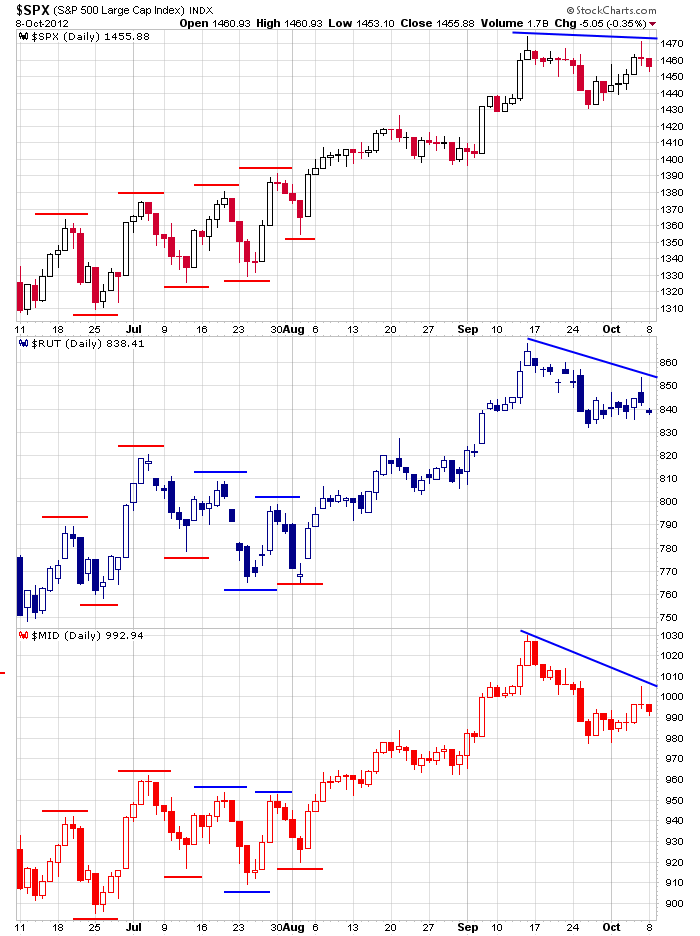

My biggest concern heading into this week was the movement of the small and mid caps relative to the large caps. Divergences between the groups almost always lead to a reversal, and although the large caps did not make a higher high last week – so technically a divergence did not form – the upside progress of the small and mid caps lagged enough to be noticeable. Here’s a chart comparing the $SPX, $RUT and $MID. If the small and mid caps do not participate in a rally, the upside will be very limited.

Otherwise the action is mostly pretty slow, and the number of good set ups we have to choose from is on the lighter side. Be conservative out there – especially as earnings season gets started. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 9)”

Leave a Reply

You must be logged in to post a comment.

Revealing season. Stronger than expected by me at least. But earnings will not be what the market is accustomed to. So caution. Things look quite, but the German lady is roaming the Provence’s so keep your finger on the sell button. As for the elections, they will come but will we notice a difference? The road is long and hard for a while. Dividends look like the core of holdings for sometime. Trading around the fringe.