Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed and with a bearish bias. Taiwan dropped 1.9%; India rallied 0.9%. Europe is currently mostly up. Greece is down 0.9%; Austria and Germany are up 0.7%. Futures here in the States point towards a gap up open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

S&P cut Spain’s credit rating to one notch above junk status. The euro did not react negatively. The thinking is this will force Spain to request a bailout.

There will be four IPOs today. Realogy Holdings (RLGY), Shutterstock (SSTK), Intercept Pharmaceuticals (ICPT), Kythera Biopharmaceuticals

FAST is out with earnings…their profit rose 13% but their margins fell. The stock hasn’t moved much before the open.

WGO is out with earnings…stock is down almost 3%.

Ruby Tuesday (RT) missed expectations…stock is down about 4.5%.

Sprint Nextel, (S) is up 18% on news the stock may be acquired.

Zep (ZEP) report Q4 earnings rose 79%…I don’t see the stock trading in premarket yet.

Initial Jobess Claims will be released today. The number is less important than the 4-week moving average, which is closely correlated to the S&P 500’s movement.

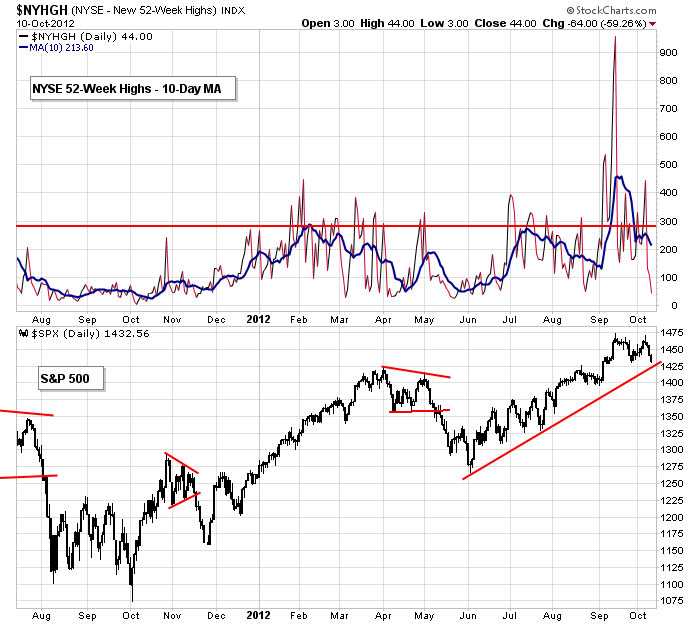

Yesterday new highs at the NYSE dropped to their lowest level since the summer. If daily prints remains subdued, the best case for the market going forward is a range. I will only believe the market can leg up again if new highs bounce back up to 300ish.

The intermediate term trend is up. When the trend is up, I’m either long or on the sidelines (never short), and it’s all based on the opportunities the market is offering and how easy trading is. Right now I’m mostly on the sidelines. I see no reason to be aggressive here. There are too many headwinds and the charts aren’t acting technically well anyways. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 11)”

Leave a Reply

You must be logged in to post a comment.

to answer Tim’s question from y/day

tomorrow i’m off to the Shanghai stock exchange as chief crazy bear

one glimpse of me will prompt frantic buying for fear that if they dont a crash will happen

this will be wave 2 up

but by the time i get to Macau next week for some real gambling,then wave 3 down will happen

Thanks AUZ – Looks like more selling a head – before the final rally into elections

Tim,

im not looking for a rally into elections

choppy trading till the 25th oct or so then down hard

why –opts ex and earnings

the fed will no doubt be long futures opts holding things up

but can they hold up –dead horse earnings

then there is europe ect

also saxo bank are cutting out daytrader margin rates and raising margins on 25th oct as are others

Sell off is around the corner?? Starting 22nd Oct after Oct expiry.

1.Technology: Jim Cramer did an exquisite analysis of the weakening outlook for this sector yesterday afternoon. Among other issues, tech is transitioning from open to closed systems such as Apple AAPL in secular move away from personal computers, AT&T T and Verizon’s VZ networks have been built out, the weakening of global economies is hurting consumer spending for tech gadgets, and the move to the cloud is disruptive to technology sales.

2.Cyclicals: The sector is exposed to a global slowdown, especially in China and Europe.

3.Financials: These stocks are extended.

4.Rate-sensitive (utilities, etc.): Names in this space are exposed to the inevitability of higher interest rates.

5.Staples: These stocks are generally fully valued after a big run.

6.Transports: Sector share prices have broken down

7. Energy – Gas prices are heading lower and sor are profits.