Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down. Japan dropped 2%; Singapore and South Korea dropped more than 1%. Europe is currently down across the board. Greece is the only index down significantly (3.5%). Futures here in the States point towards a slight down open for the cash market.

The dollar is flat. Oil and copper are flat. Gold is up a small amount; silver is down a small amount.

The IMF says European banks may have to sell $4.5 trillion in assets if policy makers fall short of pledges to stem to fiscal crisis. This is up 18% fro their April estimate.

Earnings season has official started, and the Fed the Beige Book report on economic conditions two hours before today’s close.

Alcoa (AA) cut its global demand forecast for aluminum from 7% to 6%, citing a slowdown in China. The stock is only down about 10 cents since reporting earnings.

Avnet (AVT) is down 12%.

Ferro (FEO) is down 14% – they lowered their profit outlook.

Helen of Troy (HELE) is down 6% – they guided lower for 2013.

Cummins (CMI) is down 3.5% – they lowered their forecast for revenue and earnings and are cutting 1000-1500 workers worldwide.

Yum Brands (YUM) is up 4.3%.

True Religion (TRLG) is up 24% – the company is considering putting itself up for sale.

Costco (COST) is up 2.7% – Q4 earnings rose.

Chevron (CVX) is down 2.4% – Q3 earnings will come in much lower on a sequential basis.

ESCO Tech (ESE) is down 6.3% – they’ll fall short of 2012 expectations.

International Paper (IP) is raising their dividend.

Host Hotels (HST) missed on earnings but the stock is up 1.5% in premarket trading.

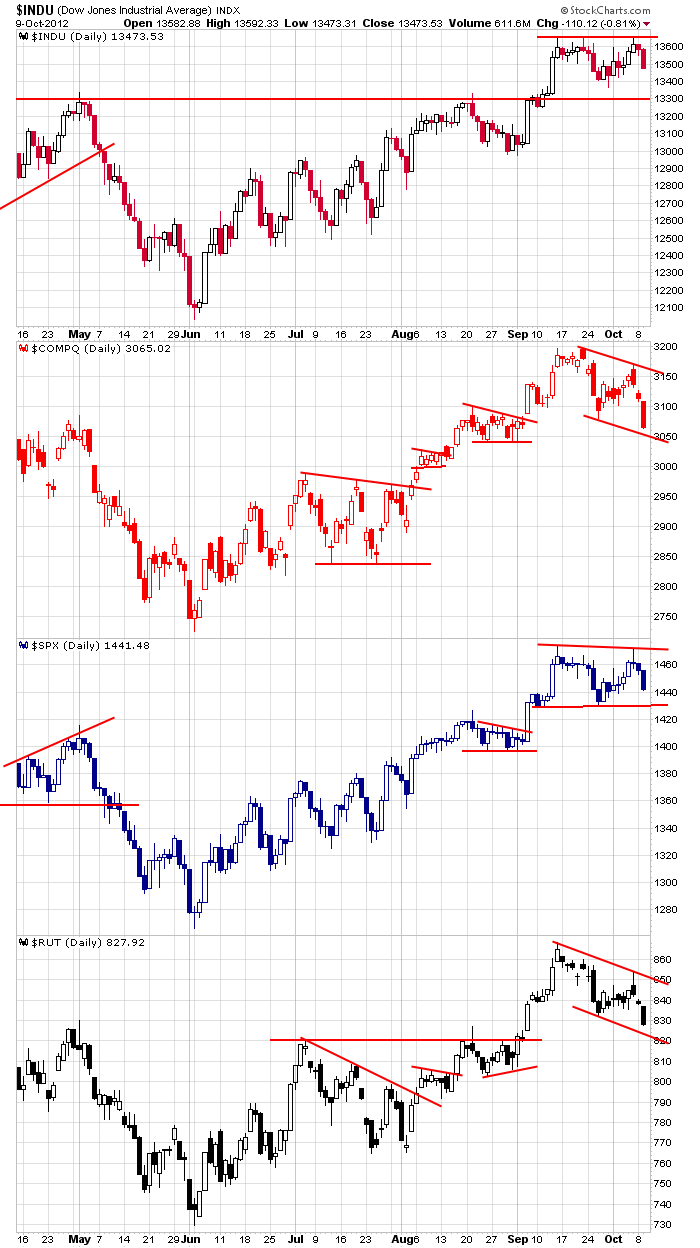

We entered this week with a cautious stance because a couple indicators had reversed off extreme levels and the small and midcaps were lagging. Here’s an update of the daily index charts. The Dow and S&P are in good shape – they’re within uptrends and moving sideways. The Nas and Russell could be considered to be trading in falling rectangles within uptrends – these are bullish, but one more down day will negate the bullishness. Obviously the lower lows from the Nas and Russell concern me the most. If the small caps lag, the market will not rally. Simple as that.

Be conservative. There is no reason to be super aggressive right now.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 10)”

Leave a Reply

You must be logged in to post a comment.

The earnings are saying more slow down. The little decline yesterday had volume. Expecting more, so short a little just to see what happens.

Think gold is in trouble. $ up for a while, Oil up too sense the supply is not stable and use will rise in winter.

Where’s Auzzie – Nice call on the DBL Top TY