Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed; there were no standout winners or losers. Europe is currently mostly up. France is up 1.4%; Germany, Amsterdam, Stockholm, Switzerland and Greece are also posting decent gains. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is flat. Oil is flat, copper is down. Gold and silver are down.

I don’t have anything to add to the comments I made over the weekend in the Weekly Report. The S&P is down 5 of 6 days and 3 of the last 4 weeks. But the damage done isn’t extreme, so for now I consider the action since the September high to be a pullback within an uptrend, not the beginning of a downtrend. Things could change, and I’ll of course change my stripes if needed.

Trading has been iffy for a few weeks. With the near term being unclear, we’ve gotten good set ups in both direction, but it’s obvious neither the bulls nor bears are in total control. Stocks move up and quickly pullback; stocks move down and quickly reverse. Day trading has presented opportunities as it always does, but there hasn’t been much for swing traders to chew on.

There are reasons to expect the market to fall apart, but we must give the benefit of the doubt to the bulls because they’ve been in control for most of the last 3-1/2 years. Many times since the March 2009 lows the bears took over for a period of time only to see the bulls grab control back and push the market to new highs soon after. Despite everything going on in the world, you have to admit the bulls have been resilient, so don’t bet against them.

As earnings season picks up, there’s no way I can post everything here. That’s not my specialty; there are plenty of other websites (MarketWatch is my favorite) out there that do a great job posting such info. I’ll focus on the bigger items.

Citibank (C) is out with earnings – the stock is up 1% before the open.

Consol (CNX) posted a surprise loss – stock is down 4%.

Softbank has acquired a 70% stake in Sprint (S) for around $20B.

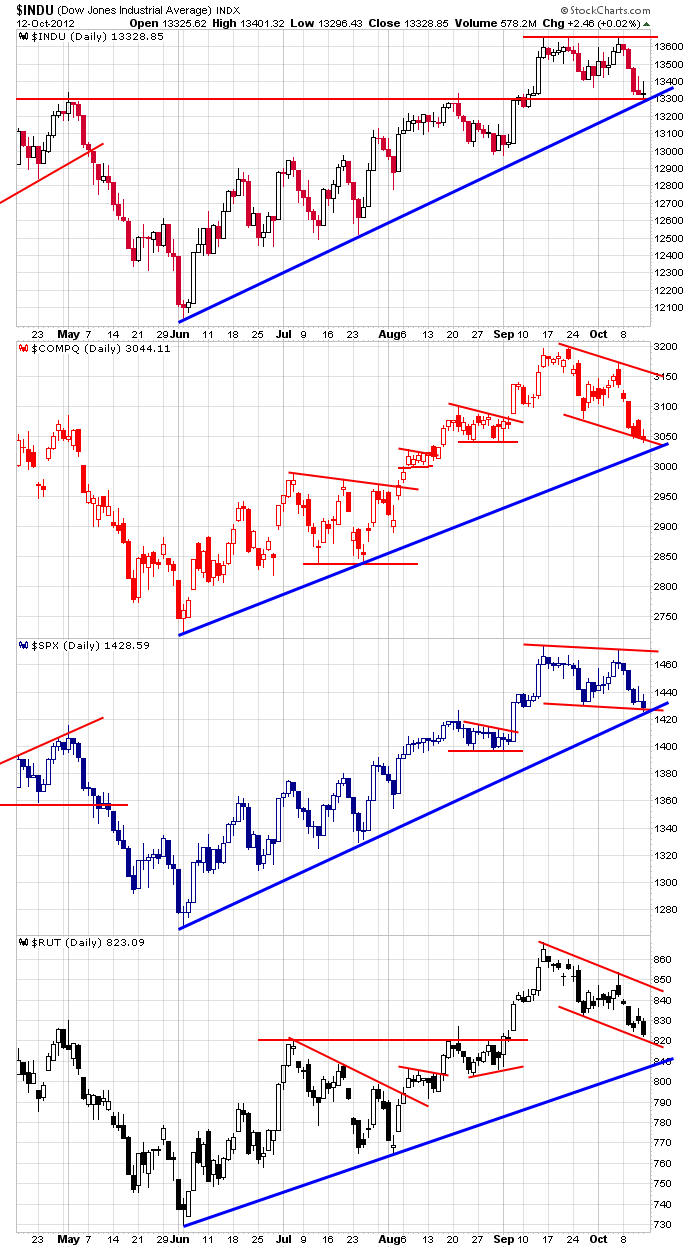

Here are the daily charts going back to last summer. All are still trending up on an intermediate term basis, but all are in the midst of a mini correction in the near term. The Dow and S&P have held up the best; the Nas and Russell have made obvious lower lows – this typically isn’t good.

With QE3 around the corner and the fact that tops typically take time to form, I would be surprised if the market just fell apart here. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 15)”

Leave a Reply

You must be logged in to post a comment.

My indicator says say invested. My core portfolio is in prpfx and is up 9.86% YTD, My trading portfolio is up 22% YTD. But I am sweating the Cliff. Nuf said.