Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

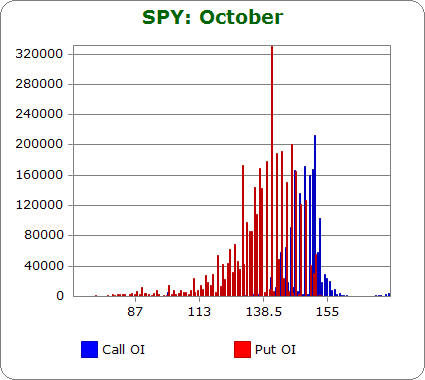

SPY (closed 144.08)

Puts out-number calls 2.2-to-1.0 – about the same as last month.

Call OI is highest between 144 & 152.

Put OI is highest between 130 & 145.

There’s some overlap at 144/145, and otherwise the call and put OI is split pretty well. A close right there would cause the most number of total calls and puts to expire worthless. Today’s close was at 144.08, which right at the lower end of the small overlap range. Hence flat trading the rest of the week would do the trick; a slight move up would be fine too. .

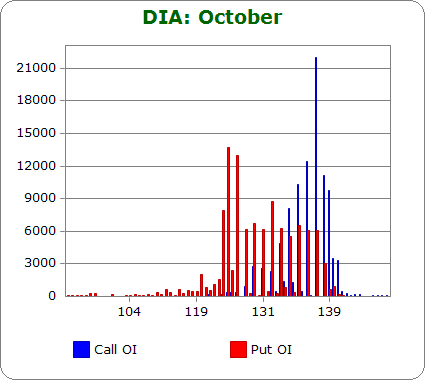

DIA (closed 134.02)

Puts out-number calls 1.2-to-1.0 – less bearish than last month.

Call OI is highest between 134 & 139.

Put OI is at 126 & 128 and then is eerily steady between 129 & 137.

There’s overlap between 134 & 137. Given that the call and put OI is nearly equal and the call OI is much greater within the overlap area than the put OI, a close in the lower half of the range would cause the most pain. Today’s close was at 134.02, right at the lower end of the range. If DIA closed here on Friday, some of those put buyers would make money at the expense of nearly all the call buyers losing. Flat trading would cause lots of pain, but a slight move up would cause a little more pain.

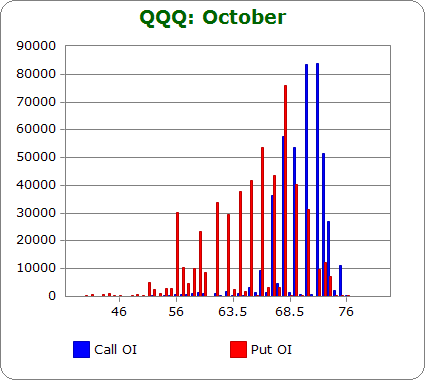

QQQ (closed 67.17)

Puts out-number calls 1.1-to-1.0 – much less bearish than last month.

Call OI is highest between 67 and 72.

Put OI is highest at 56 and then between 62 and 70 with the biggest spike falling at 68.

There’s overlap between 67 and 70, and given the spikes, I’d say a close right at 68 would cause the most pain. Today’s close was at 67.17, a little below my target. Flat trading would cause a lot of pain, but a slight move up would cause even more pain.

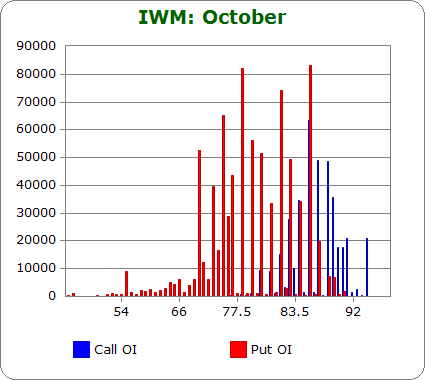

IWM (closed 82.64)

Puts out-number calls 2.3-to-1.0 – less bearish than last month.

Call OI is highest between 84 and 88.

Put OI is highest between 70 and 85 with spikes coming at 78, 82 and 85.

There’s overlap near 84/85, and given the big put OI spike at 85 a close near there will cause the most pain. Today’s close was at 82.64, well below the ideal price. Flat trading the rest of the week would enable some put buyers to cash in. A move up is needed to achieve max pain.

Overall Conclusion: The bears once again bet on a big drop, but they weren’t as aggressive as last month. The market is positioned right now to cause lots of pain among call and put buyers. A slight move up will cause even more pain.

0 thoughts on “Using Put/Call Open Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

Appears you are correct, and that we might get a move up, hopefully not too much. Your top call is probably correct as well. Appears that commodities will really come down as well as the indexes, and a number of the high flyers too. Bonds will probably reach their top of ~150 and be a sell in Nov/Dec having reach a low in yields that will reverse for a decade or more. The timing is hard, but the move is inevitable. The precious metals will likely correct hard maybe 1560 gold. Should be a buy for a run higher, but it turns on the EU and Cogress.

There a possibility of a loss of liquidity that will move the economy towards a deflation that will push stocks down to old lows. The reversal will be visible in the copper and and bond yields rising a little. This will NOT happen immediately, but likely in 2013-14. It maybe the buying opportunity of the next 20 years.

Excellent work and much appreciated Jason.

old lows? as in mid 600’s for the S&P?

So with the above info, what wouold be a ‘safe’ trade on ea of the instruments covered– IOW, how do I use this info for gain??? Thx~

I would never trade off this info. I keep it in the back of my mind but don’t use it…especially today with so many headwinds and earnings season.

Thanks Jason

What a great and eye opening lesson, Put/Call Open Interest now make sense to me. Thank you