Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. India dropped; Japan, South Korea and Taiwan moved up. Europe is currently up across the board. France, Germany, Amsterdam, Norway and London are up more than 1%. Futures here in the States point towards a relatively big gap up open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

One of the reasons overseas markets are up and futures here in the States are doing well is word from Spain they are moving towards meeting the criteria that would enable the ECB to buy bonds, thereby depressing yields.

Vikram Pandit is out as CEO of Citigroup (C) and as a member of the board. The stock is down 2.3%.

Goldman Sachs (GS) did well with earnings. The stock is up a small amount before the open.

Johnson & Johnson (JNJ) did well too…stock is up 1.2%.

Coke’s (KO) earnings were in line…stock is up a small amount.

State Street (STT) beat Q3 estimates…stock is up a small amount.

Murphy Oil (MUR) is spinning off its refining unit, paying a special $2.50 dividend and is doing a $1B share buyback. The stock is up better than 7%.

Omnicom (OMC) Q3 earnings and margins moved up slightly. The stock is unchanged.

Domino’s (DPZ) profits rose, especially those overseas. Stock is up almost 4%.

PNC is down almost 2%…earnings related.

UnitedHealth (UNH) Q3 earnings rose, and they raised their full-year guidance.

Mattel (MAT) did well with earnings…stock is up 4.5%.

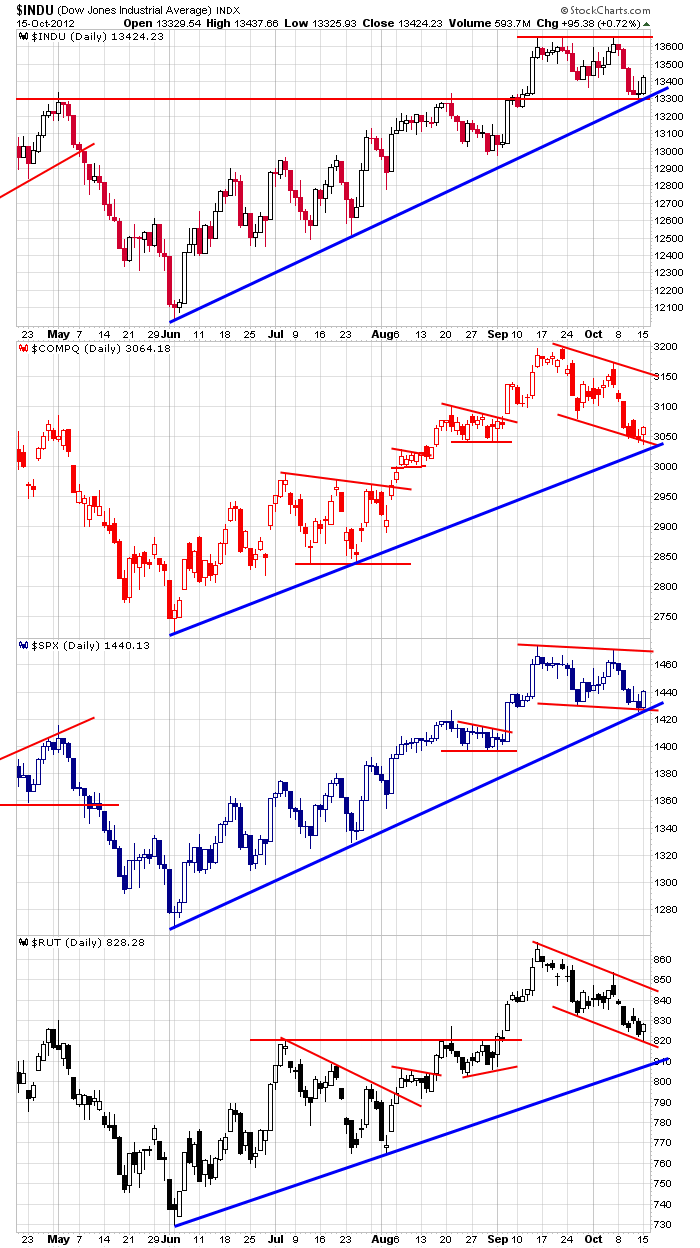

Here’s an update of the daily charts. The Dow and S&P bounced off support. The Nas got close before bouncing. The Russell bounced of horizontal support at 820 instead of the uptrend line. The longer term trend remains in good shape; the shorter term is still unclear.

The second Presidential debate is tonight. It could certainly move the market tomorrow morning because Wall St. will continue pricing in the likely winner. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 16)”

Leave a Reply

You must be logged in to post a comment.

Politics is the key apparently. The shift at City is no suprise since it is clear that both the shareholders and regulators were concerned over the bank’s future. More important, Bernanke made his case at IMF-Japan and did not convince anyone, other than himself, that his QE objectives are benign. The effects of his policy on commodities is driving the Emerging markets inflation. The kickback will hurt US exports, earnings are declining overall in the USA. These declines further pressure the multiple expansion Ben has given the US market. P is up and E is down, that equals the expected alpha: why the expectation? Congress will dry gulch the expectations. A correction of 20% is possible. Caution.

is today the sell signal i wait for

should know by high noon

if not —it should be by 25th oct

—im a top fisher

Thank You all – Jason, Whidbey & Auzzie – ;^)