Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Japan rallied 1.2%; Australia, Hong Kong and South Korea also did well. Europe is currently mixed. Belgium and Greece are up more than 1%. France and Germany are up slightly. Futures here in the States point towards a positive open for the cash market.

The dollar is down. Oil is up, copper down. Gold is flat, silver up.

Obama did well in last night’s debate. Romney held a slim lead going in, so I’m guessing it’s pretty even now. Lots of uncertainty there for the next three weeks.

U.K. unemployment dropped from 8.1% to 7.9%, a 15-month low. The Bank of England left the size of their current quantitative easing program unchanged.

Moody’s says a multiple-month downgrade into junk territory for Spain is in the pipeline if the country deteriorates any further. The lack of a downgrade helped push Spanish bond yields to a 15-month low.

IBM beat earnings estimates but missed on sales estimates. The stock is down 3.8% before the open.

INTC topped both earnings & sales estimates, but is down 4.5% in premarket trading.

Bank of America (BAC) in unchanged after releasing earnings.

Pepsi (PEP) is barely moved after releasing earnings.

Halliburton’s (HAL) Q3 profit fell 12%…stock is down 2%.

Abbott (ABT) is out with earnings…stock hasn’t moved.

Cymer (CYMI) is up 64% in premarket trading. Wow.

Mattel’s (MAT) profit rose 22%…stock is up 5.7%.

Exxon Mobil (XOM) is buying Canadian oil and gas producer Celtic Exploration.

Dover (DOV) did well with earnings but then warned of upcoming revenue concerns.

Quest Diagnostics (DGX) quarter profit dropped 5.1%…stock is down 2.2%

St. Jude Medical (STJ) is down almost 7% after earnings.

Blackrock’s (BLK) Q3 profit climbed 7.9%…stock hasn’t traded in premarket action.

Check Point (CHKP) is down 4%.

Stanley Black & Decker is down 5%.

Also out with earnings are TXT, CMA, KCG.

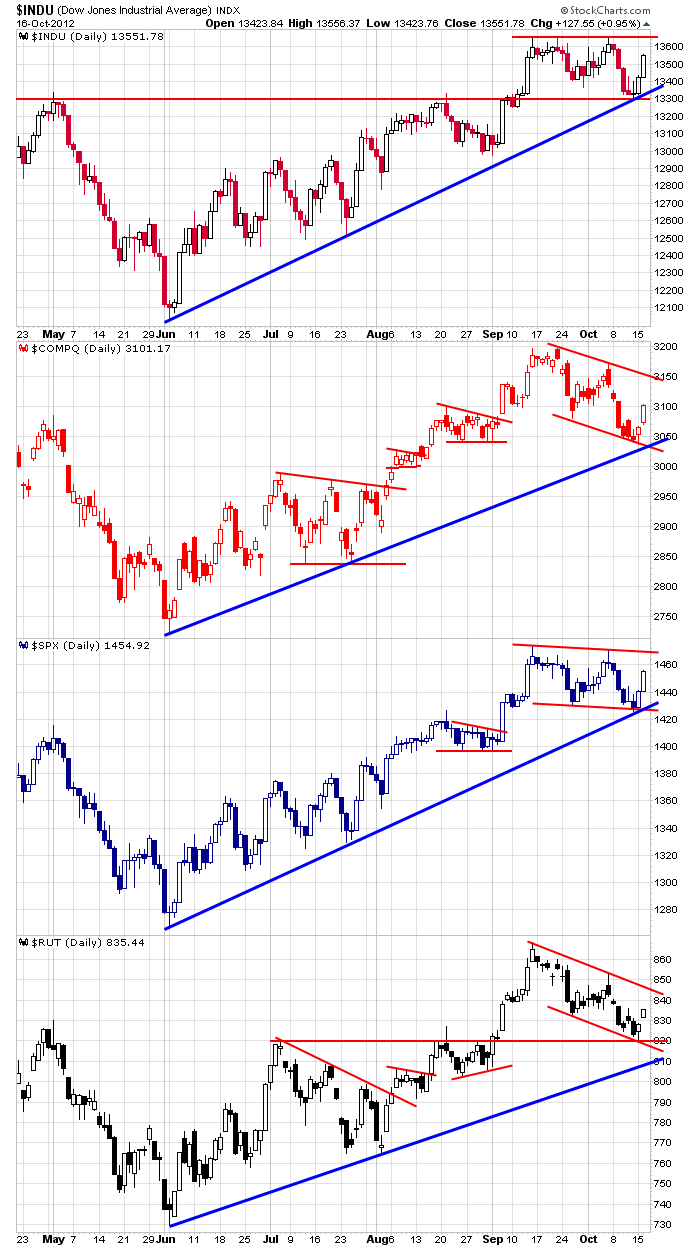

Yesterday the market added to its previous day’s gains. The Dow and SPY both bounced off an uptrend line. The Nas bounced off the support line of its falling rectangle pattern. The Russell bounced off a previous resistance level. The action has given the bulls the chance to breathe. They, no doubt, were a little on edge when the week began. But in the near term I’m still going to classify the situation as being neutral and uncertain because there is no clear trend. More after the open.

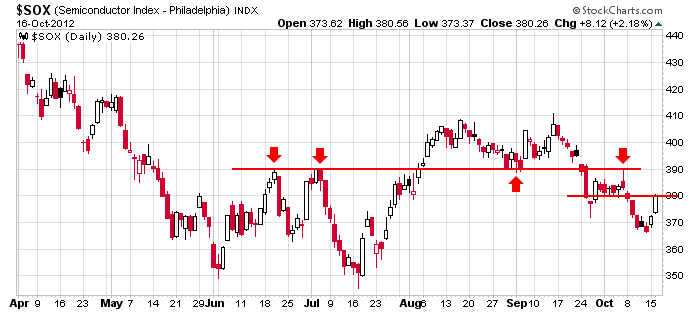

The semis put in a solid day yesterday. It’s a good step but there’s lots of resistance overhead. If the market is going to rally, the semis need to improve a bunch.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers