Good morning. Happy Wednesday.

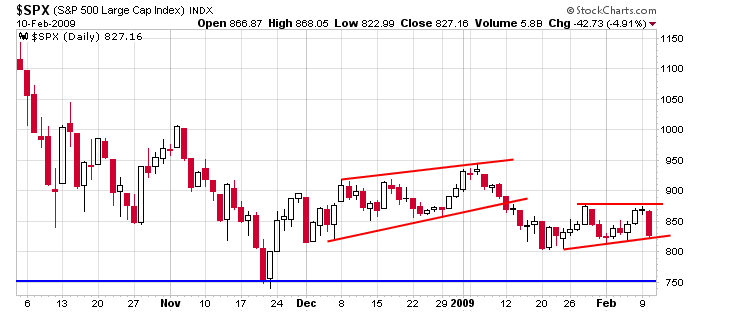

So here we are at a key level for the market – yes there seems to be many of them. For the last month, dips have gotten bought and rallies sold. Yesterday I said it would be nice if support was tested again because that would allow the consolidation pattern to mature. I just didn’t think it would happen in one day. Per the daily chart below, the SPX is now sitting at support. Follow through to the downside is likely to lead to a quick move to 750.

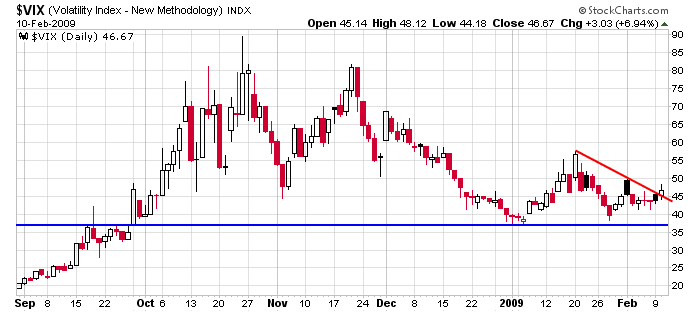

There’s no question all time frames point down, so our focus shifts back being aggressively short. Partial positions can be taken on breaks of support and positions can be added to on bounces. And if you’re thinking this move down may be short lived, consider that the VIX and put/call ratio are at relatively low levels, so odds favor the market being much closer to a top than a bottom. Here’s the VIX chart…

headlines at Yahoo Finance

movers & shakers from MarketWatch

upgrades/downgrades