Good morning. Happy Thursday.

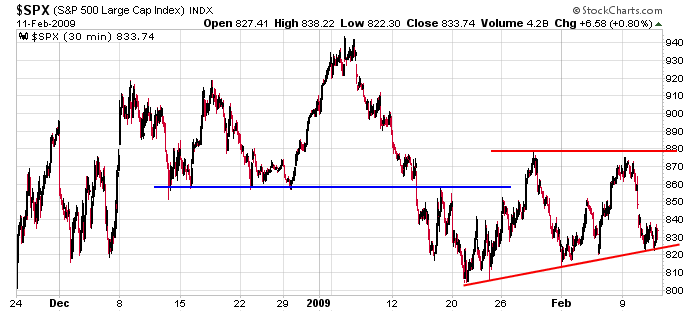

The market seems to be just barely hanging on. Yesterday I showed the SPX trading near support of a consolidation pattern that forecasted a move down to 750 or the high 600’s depending on whether the size of the pattern or move into the pattern was used to measure the move. It was stated follow through to the downside was likely to led to several intense days of selling, but for now, the market held up. Here’s the 30-min SPX chart. A line in the sand has been established. If support gets taken out, fine. The low of the bottom could hold, and support could become horizontal, but if the low of the pattern gives way, 750 will not be far off.

I get the feeling either the bulls or bears are going to get burned big time very soon. For the last month, every dip has gotten bought and every rally sold into. Sooner or later, the line won’t hold, and one of those groups will have to run for the exits.

Since the overall trend is down, I am cautiously buying dips with very tight stops and aggressively shorting rallies.

headlines at Yahoo Finance

movers & shakers from MarketWatch

upgrades/downgrades