Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. Australia, China, Hong Kong and Taiwan closed down more than 1%. Europe is currently down across the board. The Czech Republic, Norway and Greece are down more than 1%; Austria, Germany and Stockholm are down more than 0.7%. Futures here in the States point towards a big gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold is down, silver up.

Greece has been granted a 2-year extension to repay its current bailout loans, but an agreement has not been made as to how they’ll pay the loans.

Home Depot (HD) reported good earnings. The stock is up 2% premarket.

Microsoft’s (MSFT) top Windows executive has quit. The stock is down almost 4%. This news is just as big as the news one of Apple’s (AAPL) key executes was forced to resign a few weeks ago.

Henry Schein (HSIC) is doing a $300M share buyback.

AK Steel (AKS) is down about 8.6% after earnings came in below Wall St. estimates.

Aecom Tech (ACM) is down almost 10% – earnings related.

Horizon Pharma (HZNP) is up 10.4% – earnings related.

Vodafone (VOD) is down almost 4%. The company swung to a 6-month loss but will be doing a share buyback.

Weatherford (WFT) is down 9% – earnings fell 29%.

Xerox (XRX) is down 1.3% – earnings came in under estimates.

Michael Kors (KORS) did great with earnings and then raised their full-year outlook, but the stock is down before the open.

Dick’s (DKS) is up 4.6% – revenue and earnings were both up nicely related to last year.

On a closing basis, the market has traded quietly for two days, so as of yesterday’s close, I’ve been more alert to increased volatility. Unfortunately instead of getting a flat open and then a forceful move, we’re going to get a big gap down today. I hate that.

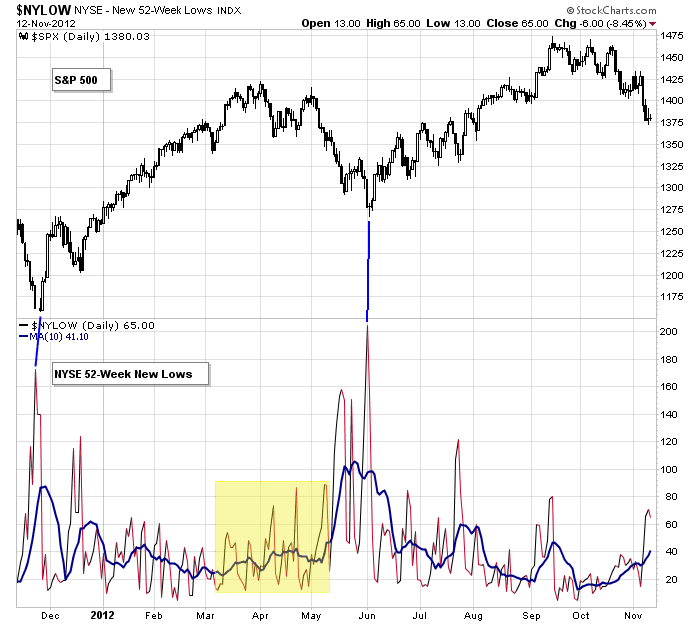

My bias, which has been down for almost two months, remains down. The market can turn any time it wants, but in my opinion, until we either get ridiculously good news or a total washout from the breadth indicators, I don’t think a bounce will last long or go far.

Here’s one indicator I’m watching. It’s the NYSE 52-week New Lows. I want to see it spike up before I’ll believe a real bottom has been put in place.

Don’t get too cute. Don’t make trading harder than it inherently is. Keep things simple, and trade what’s happening, not what you think should be happening. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 13)”

Leave a Reply

You must be logged in to post a comment.

Jason,can you write an article about Opex,like you do every month?thanks.

Yep, posted today after the close.

is a few days bounce comming on general ben’s spending habits and opt ex

made some on the compulsive down and just scalped some on the europe /usa up

a market that cant rally is sick

does it need some epsons salts or alka seltsa

unkle ben is giving it its next dose of laxative today