Good morning. Happy Friday.

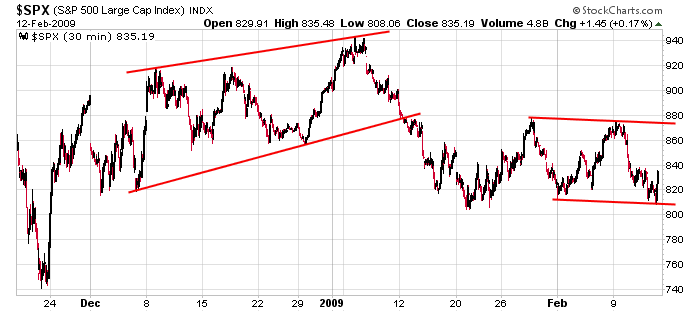

The bulls continue to defend their territory. Rallies have been getting sold for months, and for the last several weeks, the bulls have held the line on every sell-off. There are many cracks in the damn, but so far, it hasn’t broken. Here’s the 30-min SPX chart. A lot of bad news has hit the market the last month (hundreds of thousands of lost jobs), and all the market has done is sit there and absorb all of it without completely breaking down. I’m not about to call the market strong, but being able to absorb bad news is the sign of a strong market. But the flip side of that is the market must also embrace positive news which the market hasn’t been able to do other than in short spurts.

My stance and how I’m trading remains the same. Any trade to the upside is short term only – if I’m lucky I get to hold or a couple days but often trades are just day trades. On the short side, my preference is to short bounces with loose stops with intentions of letting the charts fully fun their course. You don’t get rich taking quick profits with the trend being so heavily in your favor.

The market is closed Monday for Washington’s b-day, so we have a 3-day weekend ahead of us. Have the shorts gotten too aggressive (market continues to rally), or will the longs want to use yesterday’s late rally as an opportunity to exit before the long weekend? We shall see. Certainly this isn’t a time to be aggressive.

headlines at Yahoo Finance

movers & shakers from MarketWatch

upgrades/downgrades