Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. Japan rallied almost 2%, but China, Hong Kong, Singapore and South Korea dropped more than 1%. Europe is currently mostly down. Amsterdam, Stockholm and Switzerland are down more than 1%; Germany and the Czech Republic are also posting noticeable losses. Futures here in the States point towards a flat open for the cash market.

The dollar is up slightly. Oil and copper are up. Gold and silver are down.

Walmart (WMT) posted better-than-expected earnings but missed on revenue. The stock is down 3.2%.

Viacom (VIAB) missed on revenue but earnings rose 13%. The stock is up 2.1%.

Target (TGT) did well with earnings. The stock is up 0.8%.

Stage Stores’ (SSI) Q3 loss narrowed.

Destination Maternity’s (DEST) Q4 profit nearly doubled.

Cisco (CSCO) is paying $125M is buy privately-held Cloupia.

Dollar Tree (DLTR) Q3 earnings rose 49%. The stock is up 4.6%.

Helmerich & Payne’s (HP) Q4 earnings jumped 29%; they saw double digit revenue growth. The stock is up 1%.

Perry Ellis’ (PERY) Q3 profit tumbled 51%.

BFC Financial (BFCF) is buying Bluegreen (BXG).

NetApp (NTAP) is up 11.5%…earnings related.

Facebook (FB) is up in premarket trading on top of yesterday’s 13% gain even though many shares were unlocked yesterday.

Diamond Food (DMND) is down more than 20%…they restated part of their earnings.

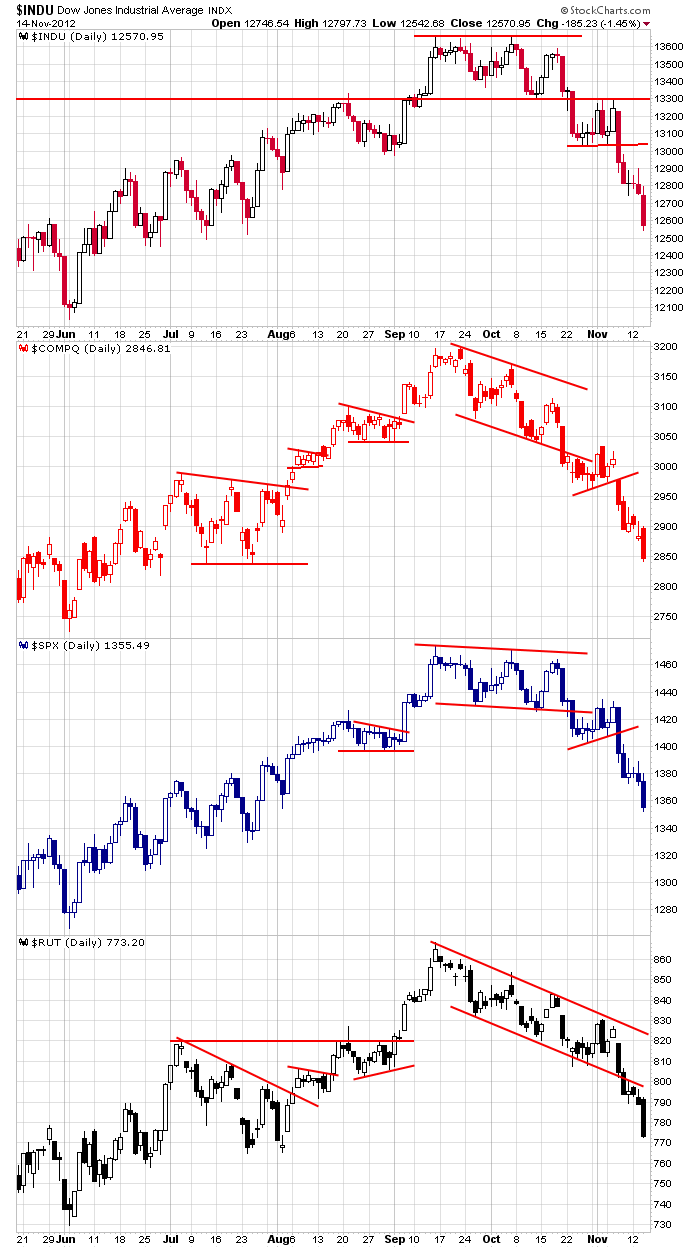

The market is practically in free-fall mode. The index charts are a mess, and charts of individual stocks are, in many cases, much worse off. This isn’t always the case. Often the indexes mask what’s going on beneath the surface. Not right now; everything is ugly. Here are the dailies…

Don’t step in front of this runaway freight train. The trend is down. Sentiment is down. The mood is very negative. But the breadth indicators haven’t washed out yet. Unfortunately for the bulls, that means we need more downside movement before a decent bounce can play out. If you’re short, don’t get cocky. The biggest up moves occur within downtrends. When the market does bottom – even if it’s only a temporary bottom – expect a forceful and energetic move. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers