Good morning. Happy Friday. Happy Options Expiration Day.

The Asian/Pacific markets closed mostly down. China and India dropped more than 0.8%; Japan rallied 2.2%. Europe is currently mostly down. Belgium, Amsterdam and London are down 0.5% or more; Greece is up 0.9%. Futures here in the States suggest a positive open for the cash market.

The dollar is up. Oil is up, copper down. Gold and silver are down.

Options expire today. There was a time when this would cause the market to be more volatile than usual, but those days are long gone. Recent (last couple years) it’s been mostly a meaningless day because traders don’t wait for the last day to square off positions.

DELL (DELL) reported disappointing earnings and then announced they’re acquiring privately held Gale Technologies. The stock is down 2.4% before the open.

The Gap (GPS) did well with earnings but then lowered Q4 guidance. It’s up 4%.

Hostess, maker of Twinkies and Wonder Bread, is filing for bankruptcy and firing 18,500 workers because management couldn’t come to an agreement with striking workers.

Penn National Gaming (PENN) is up 40%. They’re splitting their gaming and retail operations into two different companies.

Foot Locker (FL) is up 5%…earnings related.

Nike (NKE) is doing at 2-for-1 stock split, and they raised their dividend.

Smucker (SJM) posted a profit rise and raised its full-year guidance.

Starbucks (SBUX) is buying back an additional 25M shares.

Quest Diagnostics (DGX) is hiking their dividend 76%.

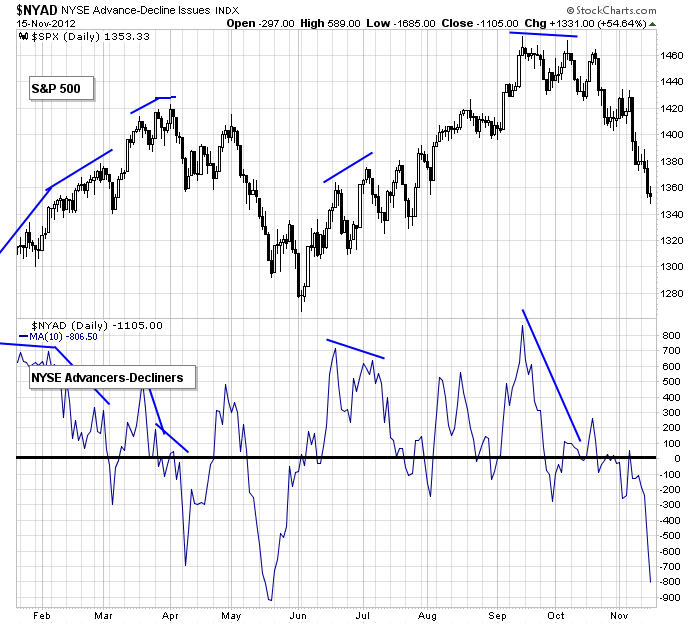

Yesterday we got a sharp plunge from the AD line.

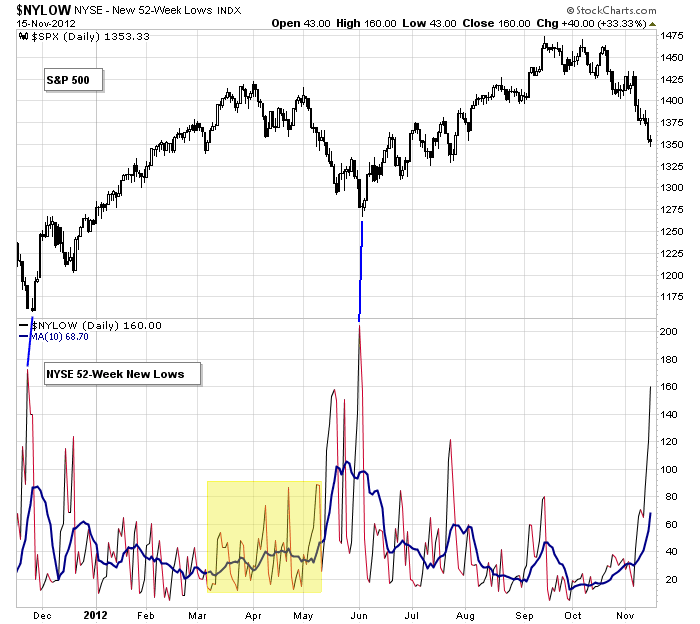

We also got a spike from the new lows.

The trend is down, but we’re getting close enough to a tradable bottom to be a little more careful on the shorts side. The easy money has been made, so don’t get carried away here. The biggest rallies come within downtrends. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 16)”

Leave a Reply

You must be logged in to post a comment.

I really was hoping for a modest gap down today to go in long. Well wait for your pitch. I will be looking for a 15 point drop in the NASDAQ from yesterdays close in the morning to go long. Otherwise time to go back and sit in the dugout.

Paul

good plan…I like your attitude