Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up. Taiwan rallied 3.1%, Hong Kong 0.8% and China 0.6%. Europe is currently mostly up. Belgium and the Czech Republic are up more than 1%. Futures here in the States point towards a positive open for the cash market.

The dollar is down. Oil is down a few cents, copper up a small amount. Gold is up, silver down.

There isn’t much influential news out, and with today being a half day, odds favor the situation at today’s close being very much the same as it was at Tuesday’s close, namely that several breadth indicators hit extreme levels and told us take profits on shorts, and so far this week has been the biggest up week in a couple months.

But the first move is the easy move because there’s pent up demand both in terms of buying interest and needed short covering. But after the first surge takes place, we need to see prices continue up on strong volume to offer evidence bigger players are stepping in. This isn’t going to happen today, but starting next week, it will be mandatory. Otherwise this bounce will ultimately prove to be a dead cat bounce within a downtrend. The market has some proving to do.

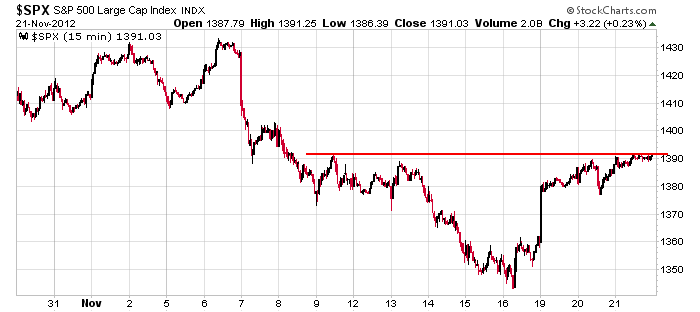

Here’s the 15-min SPX chart. I’d prefer the index to sit tight today and then attempt to break out next week.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers