Good morning. Happy Thursday.

The SPX dropped 100 points off its high from last week and couldn’t muster even a small bounce off its low yesterday. It seems inevitable the Nov lows will need to be tested and the VIX will need to spike before any meaningful bottom is put in place. Until there’s a complete washout (evidenced by 90% of stocks dropping along with 90% of volume funneling into those declining issues), bounces are shortable.

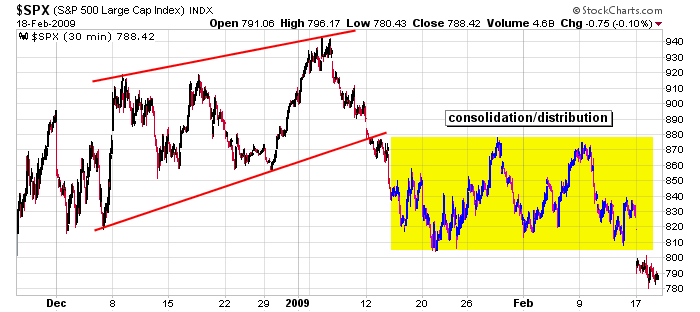

Here’s the 30-min SPX chart. That 5-week consolidation period will now act as a big block of resistance. Upside potential to the low 800’s should be relatively easy. Then things get tough.

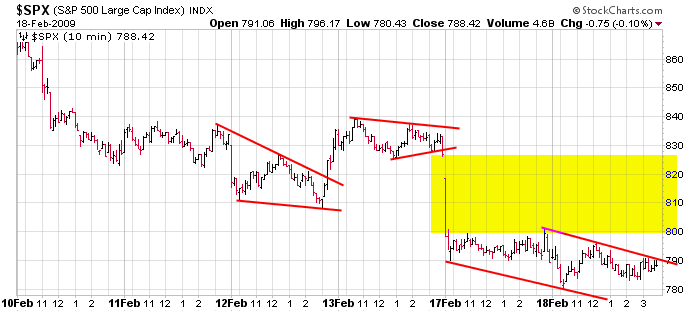

Here’s the 10-min SPX chart. After two days of relatively quiet trading, the index sits just below new formed resistance with a thin trading area above. The overall trend is down, but hey, wouldn’t a gap fill be nice. I’d rather short a bounce than a break of support.

headlines at Yahoo Finance

movers & shakers from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases