Good morning. Happy Friday.

It’s options expiration day which is totally meaningless relative to everything else going on in the market. The indexes broke down earlier this week and have been drifting lower within a tight range since. Here’s the SPX daily chart. For several weeks I’ve been saying the lows will be tested, and here we are.

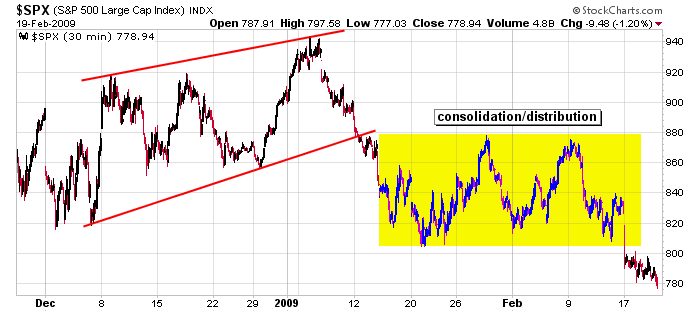

Here’s the 30-min chart. Even if we get a bounce soon, there will be a ton or resistance to deal with.

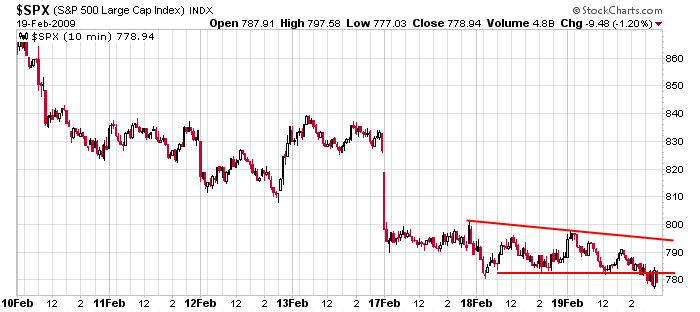

Here’s the 10-min chart. Support was taken out yesterday, and per the current premarket futures level, the index will open well below yesterday’s close.

The market feels close to being in crash mode which means it may soon be time to exit shorts and poke a few longs. I’m looking for the VIX to spike and for a day where 90% of stocks are down and 90% of volume is funneled into those declining issues. And if we get two of these types of days, I’ll definitely be looking to go long. But for now, I’m gonna keep riding the bear market down.

headlines at Yahoo Finance

movers & shakers from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases