Good morning. Happy Monday. Hope you had a good weekend.

Lots of talk this weekend about Citibank and Bank of America being nationalized. Kind of amazing. The current situation is far worse than the 2000-2002 time period when many companies that had no revenue and no business models were failing. Today we have 150-year banks going under.

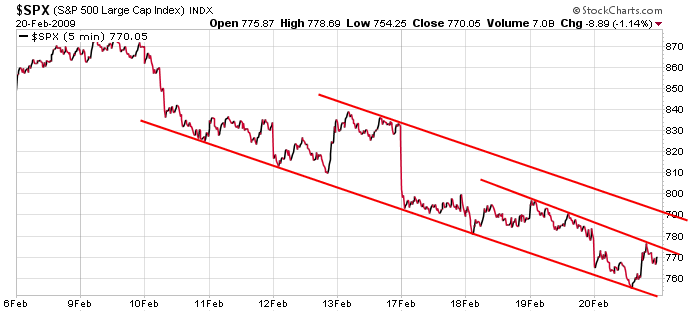

Here’s the intraday chart I’m working from. About an hour before the open, the futures market suggests the SPX will open near resistance in the mid 770’s, but a gap up within a downtrend is typically a good shorting opportunity. Some time in the first hour I’ll be going short (it’s unlikely the market gaps up and runs all day). Whether the gap entirely fills or partially fills is unknown. If after doing some backing and filling the market stabilizes and moves up, my first target – assuming resistance in the mid 770’s is taken out – is around 790. Median line theory says the slopes of significant trendlines often repeat, so although the upper trendline drawn below uses only one point (how can you drawn a line with only one point?), it uses the slope of the other two lines which have proven to contain the movement. After that, my target is 810.

But overall we still haven’t gotten a complete washout, so regardless of whatever bounce we get – if we get a bounce – I don’t expect it to last. I’m still looking for the VIX to spike up and a 90/10 day where 90% of stocks decline and 90% of volume goes into those declining issues.

headlines at Yahoo Finance

movers & shakers from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases