Good morning. Happy Wednesday.

The Asian/Pacific markets closed up across the board. China and Hong Kong posted big gains. Europe is currently mostly up. Austria is leading the way, other gains are modest. Futures here in the States point towards a gap up open for the cash market.

The dollar is up. Oil and copper are up. Gold is up, silver flat.

Heading into this week we were expecting a little give back to allow the charts to rest and the indicators to cycle away from their extreme levels. So far this is exactly what has happened. The selling pressure hasn’t been extreme and the points given back haven’t been much, so it seems the bulls are maintaining some level of control. I’d like to see more weakness but research reveals enough good long set ups to make me wonder if we’ll get the correction needed that fully allows the market to rest. We’ll see. In the near term I’m neutral; in the intermediate term I’m cautiously optimistic.

Pandora (P) is down almost 15% after offering a weak outlook.

Facebook (FB) is being added to the Nasdaq 100.

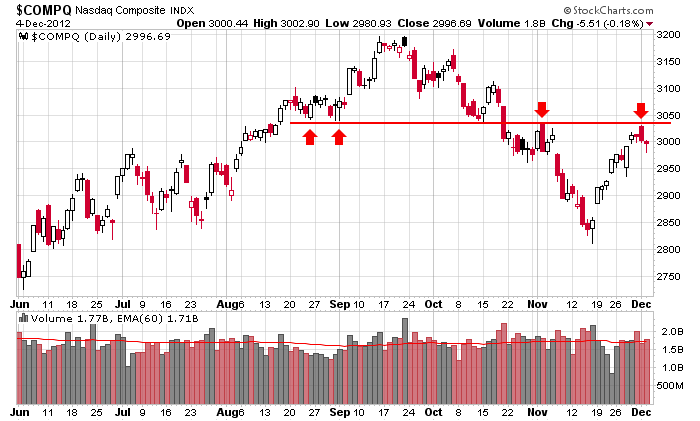

Speaking of the Nasdaq, I’m watching the level noted below. It’s got to be taken out on any rally attempt and then held on any subsequent correction. Hence why I’m cautious in the intermediate term. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers