Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed with little overall movement. Europe is currently mostly up. Greece, Austria, Germany and Norway are posting solid gains. Futures here in the States suggest a flat or slightly down open for the cash market.

The dollar is flat. Oil and copper are down. Gold and silver are down.

Yesterday the market started weak but then ‘V’ bottomed and recaptured most or all of its losses. The final numbers were split with the Nas and Nas 100 dropping and the Dow doing well. As I stated in yesterday’s report I don’t think it’s a good sign when big companies are moving in opposite directions. Little divergence will always appear, but when BAC and C do great and AAPL and FCX get crushed, a warning sign is issued. Having a low correlation coefficient is one thing, but moving so obviously in different directions is another. It’s a warning we need to pay attention to.

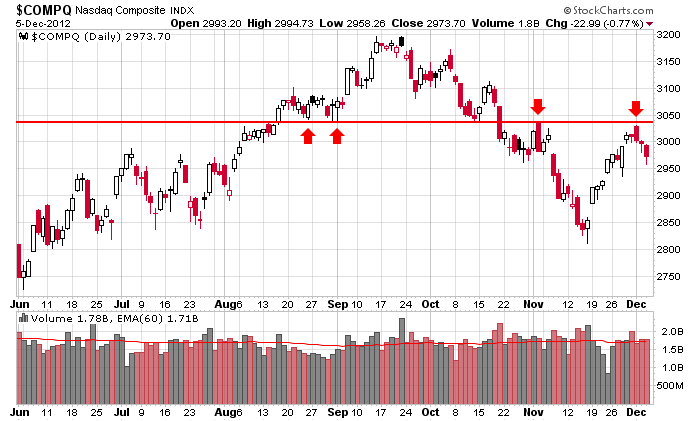

Here’s an update of the Nasdaq chart I’ve posted a couple times. Any rally attempt that does not include the Nas taking out resistance near 3030 will get turned back.

Finisar (FNSR) posted mixed results…the stock is up almost 5% in premarket trading.

Lululemon (LULU) did well with earnings…stock is up 1.6%.

Titan Machinery (TITN) is up 6.7%…earnings related.

Smithfield Foods (SFD) is flat after earnings.

Tomorrow morning we’ll get the latest employment numbers an hour before the open.

There are lots of cross-currents right now. Risk is elevated.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 6)”

Leave a Reply

You must be logged in to post a comment.

as usual, superb. But the longer range is likely down for a time. I think that an ABC down to about 1230 is possible. Of course we trade the news, so a good jobs number will be good for 30 minutes.