Good morning. Happy Wednesday.

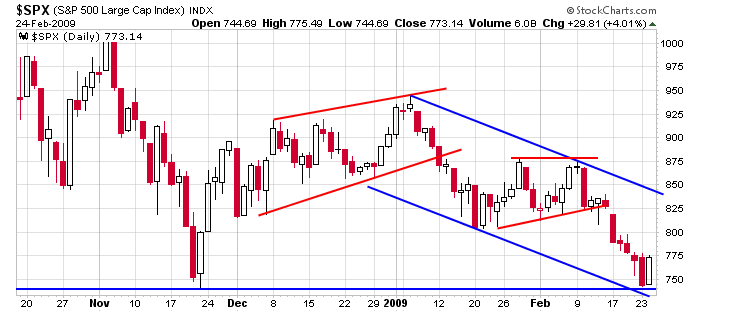

At least for the near term, the SPX seems to have found support near its Nov low. Here’s the daily chart posted before yesterday’s open. Support from the Nov low and support created from a trendline drawn parallel to resistance and through a low within the pattern have held.

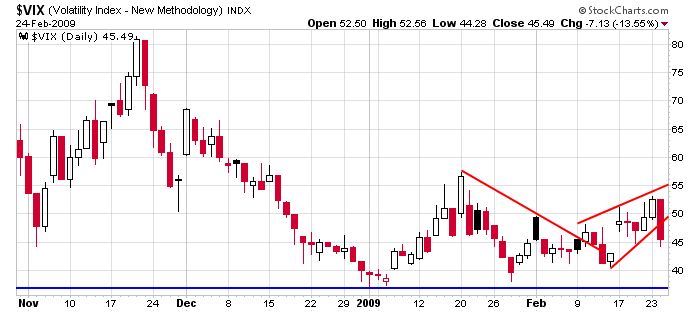

All of Monday’s losses were recovered yesterday, so the market is approx flat for the week so far. Talking heads on TV are getting excited about a bottom being put in place, but I personally think we have much more downside to go. In fact I don’t even think this bounce will last long. We didn’t get the total washout needed to completely break the back of the bulls, so for now, I’m treating this bounce like a bounce within a downtrend – not the beginning of an extended move up. Here’s the VIX chart. It’s not exactly indicating much fear in the market, and without fear, there will be no bottom.

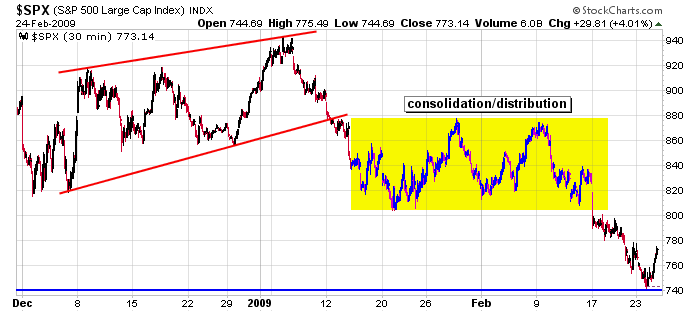

Here’s the 30-min SPX chart. It should be clear sailing until 800 or so when the index bumps into a block of resistance. Then we’ll get to see how strong the bulls really are. If the SPX can’t get up to 800, then it’s much weaker than I think.

So the overall trend is down, but let’s respect the possibility a little bounce has started.

headlines at Yahoo Finance

movers & shakers from MarketWatch

upgrades/downgrades

earnings & economic releases