Good morning. Happy Wednesday. Happy Fed Day.

The Asian/Pacific markets closed mostly up. Taiwan rallied 1%; Hong Kong and Singapore moved up 0.8%; Malaysia, Japan and South Korea also did well. Europe is currently mostly up, but there are no standout winners. Futures here in the States point towards a positive open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

Today is FOMC day; it’s the day the Fed announces the discount rate and target for overnight rates. But rates haven’t changed in a very long time, and they’re not going to change. And with QE Unlimited announced not too long ago, you’d think this meeting was a non issue. Not so. Evidently Wall St. expects the Fed to announce QE4, an open-ended commitment to $45 billion per month in unsterilized purchases of long-dated U.S. Treasury bonds, to replace the expiring Operation Twist. Expectations set up potential disappointment, so be on your toes. Then Bernanke will take part in a press conference.

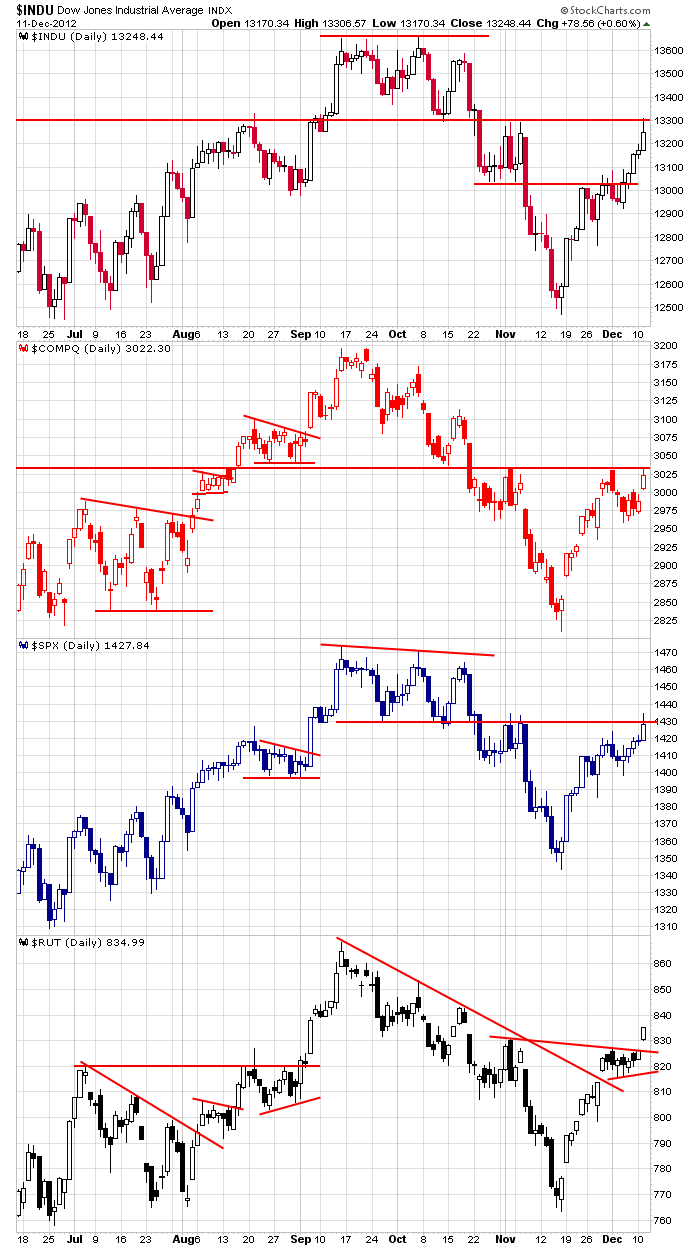

Here’s an update of the daily index charts. The Russell gapped out of a small consolidation pattern yesterday. The Dow and Nas rallied up to a previous support/current resistance level and got turned back. The S&P took out a key level but close below it. This is when things get more interesting. I like seeing the small caps lead, but they’re not going to run on their own. Throw in today’s FOMC meeting and the on-going fiscal cliff talks, and we have ourselves enough cross-currents to keep us on our toes.

My stance remains the same. I’m cautiously optimistic. We’ve had lots of good trades lately, but we have to maintain our defensive posture and make sure we don’t give profits back. Don’t let a big profit turn into a small profit. Don’t let a small profit turn into a loss. And definitely don’t let a small loss turn into a big loss. Be a trader. The market expects the fiscal cliff to come and go without incident much like Y2K did. If everyone expects this, we could get a “sell the news scenario.” More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers