Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. China dropped; Japan, south Korea and Taiwan rallied. Europe is currently down across the board. Greece, Stockholm and Germany are posting the biggest losses. Futures here in the States point towards a flat open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

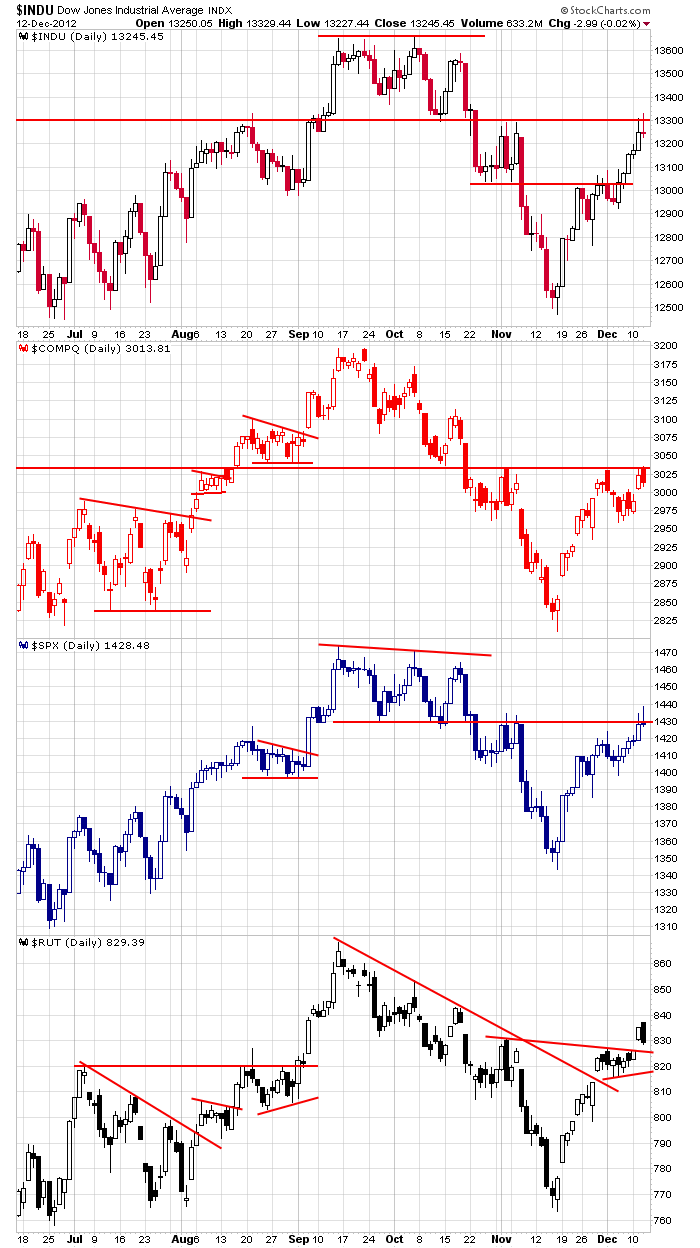

Here’s an update of the daily index charts. The Russell, which had already gapped out of a small consolidation pattern, formed an ugly bearish engulfing candle. The Dow and S&P both penetrated resistance yesterday but closed at their lows and below their respective resistances. The Nas got rejected by resistance.

We entered yesterday with a lot of cross-currents. The small caps wanted to rally, but the large caps and Nas would need to follow along. The FOMC was an unknown but was going to come and go while the fiscal cliff talks were going to linger. With resistance just overhead for many of the indexes, it seemed to be do or die time, it seemed like the market needed to bust out and run or rest – one or the other. The problem was the market had already rallied five straight days, so it needed to restore its spent energy, and although the time of year would suggest good feelings and upward price action, could we really expect a full-blow rally prior to the fiscal cliff being dealt with. Needless to say, there were lots of cross-currents and we ended up getting false breakouts yesterday.

I’m maintaining my stance. I’m cautiously bullish, but we have to play good defense.

CVS (CVS) has hiked its dividend 38% and is doing a $4B buyback.

Barclays is cutting 2000 jobs.

Ciena’s (CIEN) Q4 loss widened.

Best Buy (BBY) is up 14%…more rumors of the stock being taken private.

Companies either pulling forward dividends to this calendar year or paying special one-time dividends include: CAT, INDB, TRLG, ECOL, BGG, LM, MTSC, STSA, BBGI, IPGP, HTLF, CCUR.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 13)”

Leave a Reply

You must be logged in to post a comment.

New moon, could be a change in direction, 1372 looks like a fib target. But the Bernanke

did a new number that did not seem anything less than insane. We are again in a new land being lead by a sage or a fool. Be careful.

the bull aint dead yet

just whipsawing for the quad witches that control the universe

big boy insto market makers are playing both sides

wait for their sell signal as the flood the world with supply

political hour

the usa needs to get sane

cut all entitlements–means test healthcare and tax those above 250 grand a year that dont take out private insurance–change tort law about sueing doctors–stop business sector paying for workers health insuance–make it the responsibility of the individual

raise the retirement age

means test unemployment benifits and have work for the dole to build bridges /roads ect

subsidize small and big business to hire unemployed

raise capital gains to a sane level

have a one off wealth tax to pay for uncle ben

change the pork barreling rule for special interests

make it a criminal matter to hide debt of balance sheet and make directors personally liable for company failure and misdeads

WHY SHOULD SOMEONE MAKING I BILLION A YEAR BE ENTITLED TO FOOD STAMPS

but unless the rich get their food stamps the market might crash

closed my shorts

nice to see all indexs back in sync intraday

so now we have quad witch fri range

or is this the start of something big

euro not yet confirming

—cheif crazy bear—-