Good morning. Happy Thursday.

The Asian/Pacific markets closed with a lean to the upside. Hong Kong, South Korea, Japan and Taiwan did the best; Indonesia performed the worst. Europe is currently mixed. Belgium and Amsterdam are up the most; Austria and the Czech Republic are down the most. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

The ECB is leaving the benchmark refinancing rate unchanged at 0.75%.

The Bank of England is leaving interest rates unchanged at 0.5%, and the size of its asset purchase program will remain unchanged.

Greek unemployment rose to a record 26.8%, and among the county’s youth, it rose to 56.6%, also a record.

Molycorp (MCP) is down almost 12% premarket…it warned 2013 revenue will fall short of expectations.

Ford (F) has doubled its dividend from 5 cents to 10 cents.

Ascena (ASNA) is down 11% before the open…it cut earnings estimates for the current fiscal year.

Tiffany (TIF) is down 8%…it steered analysts lower regarding its earnings for the current year which ends Jan 31.

Fisher Communications (FSCI) is up 11% premarket…they’re exploring whether to sell the company or not.

Herbalife (HLF) is up 3.3%…I’d stay away from this stock…there are too many big hedge funds playing games in the media with it.

AIG (AIG) says it won’t sue the government for what it thought was unfair conditions of its bailout.

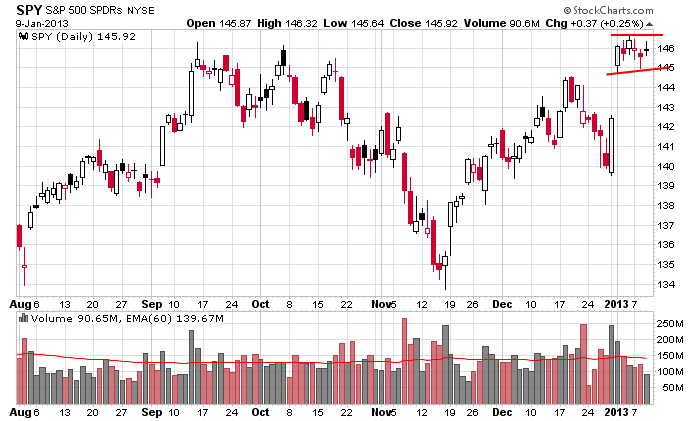

Here’s the S&P via SPY (because it shows gaps). Other than the gag up on Jan 1, the market has traded quietly in a relatively tight range for the last six days. This is perfectly normal and healthy action for a market in a mini uptrend – it moves, then it rests. With earnings season here, we may get a few more of these range-bound days. Then after an earnings trend begins (are companies beating or falling short of expectations), a new move can begin.

I’m also seeing some improvement from some of the indicators which have held the market back lately, so for now, my bias remains to the upside. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 10)”

Leave a Reply

You must be logged in to post a comment.

The set up is for a sharp let down.I mess around with cycles which is witchcraft.

Suspect the dollar goes to 84 before its over and gold reaches 1560 and is a buy, but not a good investment. Short Yen, and maybe the Euro here shortly. I am riding the midcap index and playing a few firms that seem to have strength: ARNA has a good story and has moved up a little. Holding income plays like PWE for 7-8% yearly cash flow. Weird things, in a weird market.

At this point I don’t trust this market. I don’t have to hit against screw ball pitches. I will wait until there is a curve ball pitcher on the mound. Then I will get up to bat.

I have looked back for a gap up and flag like we have now and there just have never been any. I do see the market taking off from here. Conversely I do see the gap getting filled. Since I have no clue what the market will do next it is time to go to a neutral position and wait.

Paul

Short the SPY –