Good morning. Happy Friday.

The Asian/Pacific markets closed with a bearish slant. China dropped 1.8%; Hong Kong, Malaysia and South Korea also lost ground. Japan rallied 1.4%. Europe is currently mixed. Austria and Belgium are leading to the downside; Switzerland and the Czech Republic are leading to the upside. Futures here in the States suggest a flat open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

Wells Fargo (WFC) is out with earnings…the stock is down 1.4% premarket.

Infosys (INFY) is up 15%…the company lifted its outlook and annual revenue projections during its earnings call.

Ford (F) is up premarket…they’re hiring 2,200 workers this year to help support the introduction of new products.

Best Buy (BBY) is up almost 7%…a key revenue metric declined during the holiday season, but online revenue showed strong growth and their flat overall performance was better than the last few quarters.

Apple CEO Tim Cooks says China will be its biggest market. We’ll see. They need to come out with a much cheaper phone.

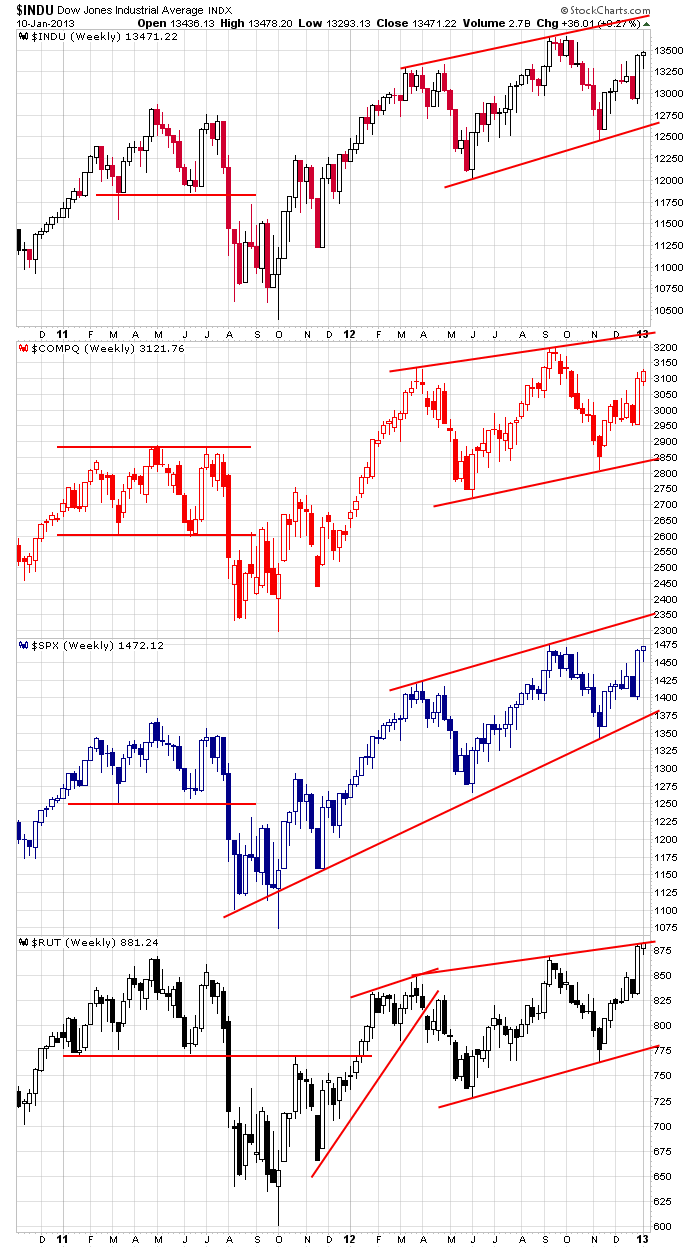

With one day of trading left, here are the weeklies. The Russell is at an all-time high but is also at a potential resistance level. The S&P is near a multi-year high. The Dow and Nas are lagging. The Dow, Nas and S&P have room to move before hitting resistance created by a trendline drawn through the previous tops. The overall trend off the 2011 bottom is up, and the near term trend off the November 2012 is also up. But we’ve had some wide swings, so getting married to a stance has not been wise.

Within an uptrend, you are either long or on the sidelines. Within a downtrend, you are either short or on the sidelines. Right now, I see no reason to be anything but long. I don’t fight trends, and I don’t guess top unless the technicals tell me a top is likely in place. Get rid of your ego and strong attitude if you want to make money.

More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 11)”

Leave a Reply

You must be logged in to post a comment.

This uptrend I don’t trust. It is time for this boy to ride the pines.

Paul

understanding is the universal solvent

the world is at war –a currency war and this effects bonds/equities

same as the 30’s trade war

at the moment japan is killing germany and europe

a few more days of japan buying euros to 1370 and thats it

the german dax to led markets lower –europe has toped and is doomed –usa close

be a counter trend trader and experiance the exhilerhation of life

there is a trading plan for everything

Appears to be a decoupleing in Bonds and Stocks – Thanks AUZ – Keep Cool –