Note – This report was written over the weekend because I’ll be away on Monday.

Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

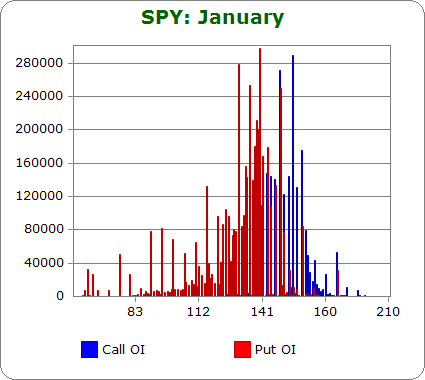

SPY (closed 147.07 on Friday)

Puts out-number calls 1.9-to-1.0 – slightly less bearish as last month.

Call OI is highest between 140 and 150 with the two big spikes occurring at 145 and 148.

Put OI is highest between 132 and 145 with the biggest spikes occurring at 135, 140 and 145.

It’s pretty clear the bulk of the put open-interest falls on one side of the chart and the call OI on the other. The overlap is between 140 and 145, and both calls and puts have a big spike at 145. A close on Friday in the middle of the overlap range will cause a lot of pain because most options will expire worthless. A close at 145 will close virtually all puts worthless but allow a few call buyers to make money. With last Friday’s close at 147.07, SPY is above the range. This isn’t all bad. Puts out-number calls almost 2-to-1, so closing all the puts worthless will somewhat accomplish the market’s “max pain” goal, but a move down would cause more pain.

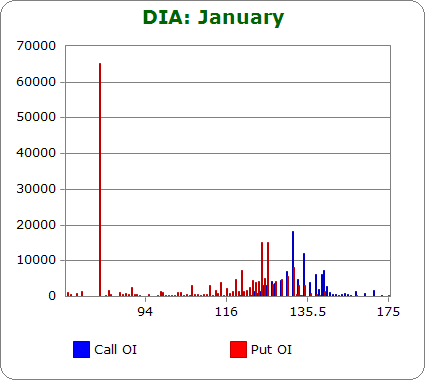

DIA (closed 134.72 on Friday)

Puts out-number calls 1.7-to-1.0 – much more bearish than last month.

Call OI is highest at 133, 135, 137 and 139.

Put OI is highest at 75 (???), 127, 129 and 133.

There isn’t enough volume here to draw any conclusions from. High OI for SPY is 200K; high OI for DIA is 10K. These DIA numbers mean nothing, so I’ll just briefly mention the two OI zones meet at 133, and with Friday’s close at 134.72, a move down is needed to close all options at the meeting level worthless.

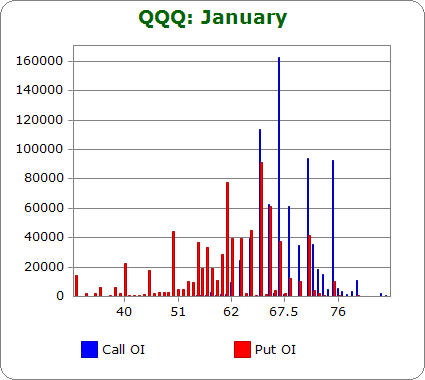

QQQ (closed 67.26 on Friday)

Calls out-number puts 1.2-to-1.0 – less bearish than last month and the second consecutive month in several years call open interest is greater than put open interest.

Call OI is highest 65-68, 70 and 75.

Put OI is highest at 50, 55, 57, between 61-67 and at 70.

There’s a lot of overlap between 65 and 70, and for only the second time since I’ve been writing these reports, call OI out-numbers put OI. A close near the middle of the overlap range will cause a lot of pain, but since the two biggest call spikes occur in the bottom-half of the range, I’m tempted to say a close down there would cause even more pain. Friday’s close was at 67.26 – slightly below the middle. Flat trading this week will cause lots of pain, but a slight move down will cause more.

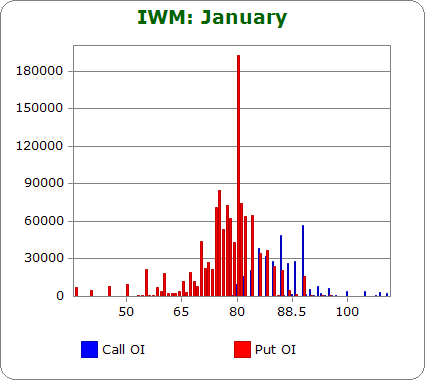

IWM (closed 87.34 on Friday)

Puts out-number calls 3.0-to-1.0 – more bearish than last month.

Call OI is highest between 84 and 90.

Put OI is highest between 74 and 83, and that big spike takes place at 80.

Puts completely dominate, so let’s focus on closing most of those worthless. Friday’s close was at 87.34 – well above the upper part of the put high-OI range. Flat trading will cause lots of pain, but a move down will cause more because most of the puts will still expire worthless and a few extra calls will too.

Overall Conclusion: The bears bet big again, and they’ll lose again. The development that stands out the most is the extreme level of IWM puts taking place at the same time the Russell 2000 is making all-time highs and leading the market higher. You’d think contrarain thinking wouldn’t work because it’s well advertised, but it does. As of now, lots of pain will be caused if the market trades flat the rest of the week, but if it moves down, more pain will be inflicted.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

I am waiting for /TF down below 873.8 , then offically bear come along

only stuff that makes sense in terms of predicting the market.

Reads like a Russian novel, the plot is well known, as is the likely outcome, yet the attraction to the game is overpowering even though the hero knows his probable fate. This just can not be a smart group that we belong to. I am long a few indices and short the Yen and a little ahead. More than that, I have a buy list for the run up into Feb 13, before the let down. Thank you for the analysis.