Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed and with an upward bias. There were no big losers; China, Malaysia, Japan and Taiwan did well to the upside. Europe is currently trading mixed and with a downward bias. Belgium and Greece are up; France, Germany, Amsterdam, Norway, London, Italy and the Czech Republic are down. Futures here in the States point towards a slight down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

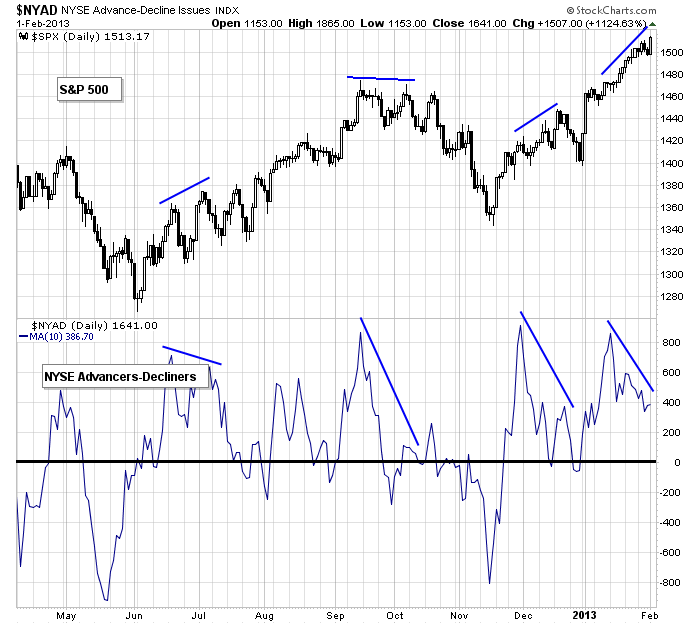

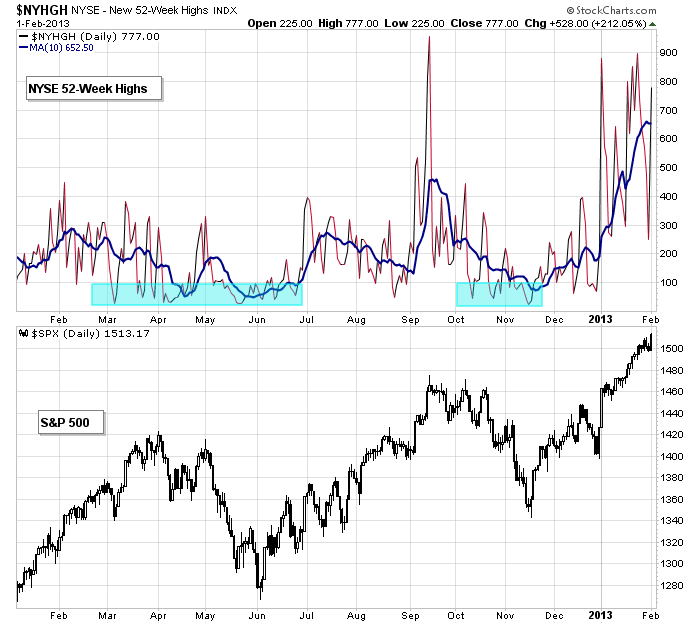

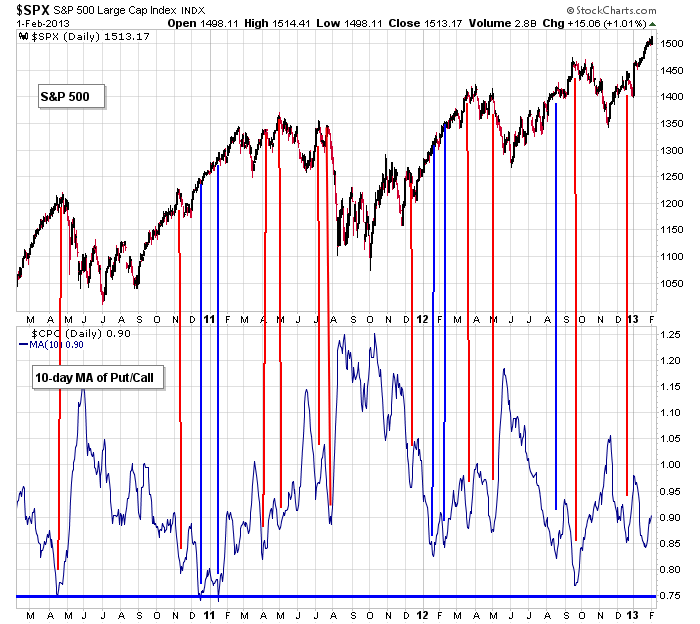

I don’t have anything to add to my weekend comments posted in the weekly report. In the near term there are warnings. The AD line is lagging, new highs may be consistently too high and the put/call ratio has curled up from a local bottom. These tell us to be cautious in the near term or at least manage to our positions wisely. But the longer term charts look great and are not suggesting a top is forming. So I like the market overall, but in the near term I’m maintaining my cautious bias.

Here are those shorter term, more sensitive indicators.

AD Line

New Highs

Put/Call Ratio

The following companies announce earnings today before the open. Humana’s (HUM), Gilead (GILD), Simon Properties (SPG), Anadarko (APC), Yum Brands (YUM), Sysco (SYY), Hartford Financial Services (HIG), Edwards Lifesciences (EW), Clorox (CL), Royal Caribbean Cruises (RCL), Legget & Platt (LEG) and Gannett (GCI).

With a lack of major scheduled news items, earnings will take center stage. But lack of news could also mean lack of direction, lack of sign posts. The market likes to cling to something, but it’s unknown what that thing will be this week. We’ll see. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 4)”

Leave a Reply

You must be logged in to post a comment.

Still don’t see upside from here a pull back is needed.

i smell burnt bull

but it maynot be of to the aboutouires for the deap freze just yet

be a daytrader and enjoy the barbaque

good to see neil might be back

as a investor Neil might be retireing

investors dont like bears or daytraders—-lol

the dax has daxed the nasdax

the ftse has footsied the dow

what will the afternoon session bring

have world central banks now retired