Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed and with an up bias. Japan rallied almost 4%; Australia, Hong Kong and Indonesia also did well. Malaysia and New Zealand dropped. Europe is currently mostly up. Greece is up almost 3%, and Stockholm almost 2%. Futures here in the States point towards a flat open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down slightly.

Time Warner (TWX), Visa (V), News Corp (NWSA), CVS Caremark (CVS), Green Mountain (GMCR), Allstate (ALL), Intercontinental Exchange (ICE), Coventry Health Care (CVH), DeVry (DV) and Ralph Lauren (RL) have earnings today.

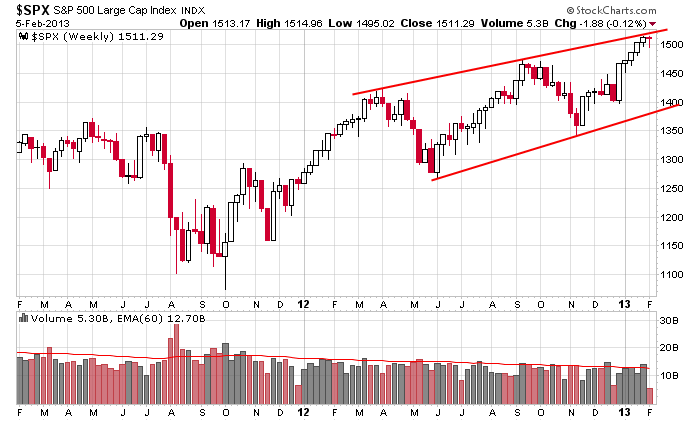

The market has been all over the map the last three days…big up day Friday, big down day Monday, big up day Tuesday. The weekly S&P chart is right at a potential resistance level, and until this level proves to be significant or irrelevant, we need to proceed with caution.

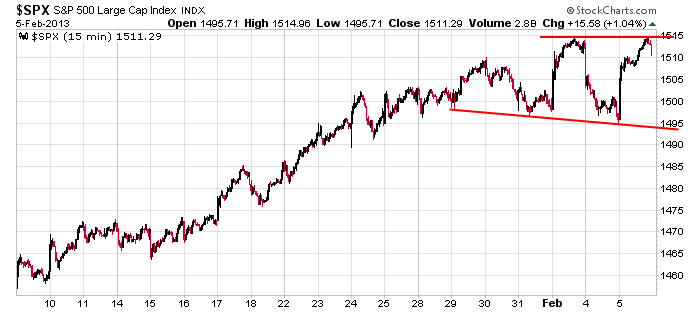

vThe 15-min chart shows a broadening pattern with lower lows and the same high. Such patterns hint at an impending expansion in volatility.

I continue to like the market on a long term basis, but in the near term, things are less clear so I’m not taking any chances. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers