Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed and perhaps with a slight bearish bias. China, Japan and Singapore led to the downside; Australia, Malaysia and Taiwan led to the upside. Europe is currently mixed. Belgium is suffering the biggest loss while Austria, Spain and Norway are up the most. Futures here in the States – 2-1/2 hours before the open – point towards a slight up open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are down.

Rumor is American Airlines parent AMR and US Airways (LCC) will merge to form the largest airline in the world.

Earnings today include: New York Times (NYT), Sprint Nextel (S), LinkedIn (LNKD), Hasbro (HAS), Cigna (CI), Activision Blizzard (ATVI), Coinstar (CSTR), Gartber (IT), Monster Worldwide (MWW), Philip Morris (PM) and Republic Services (RSG).

So far this week we’ve gotten a big down day, a big up day and a pause day. The S&P’s net change since last Friday is down one point, so we’re basically flat on the week. This isn’t a surprise because coming into the week the near term was not clear. A couple indicators hinted at a needed correction or pullback, and if the indicators started to matter again – remember there was a period where they, and all other things, were completely ignored – the upside was limited.

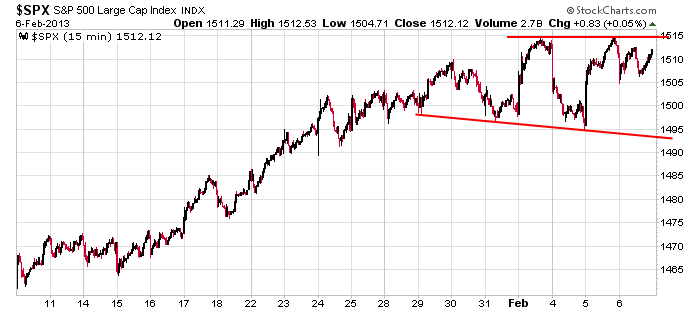

Here’s an update of the S&P’s 15-min chart. Yesterday’s range was small relative to the last three days. A breakout doesn’t automatically mean it’s party time. A higher high followed by a sell-off would create a megaphone pattern – a common pattern that often forms at tops and right before volatility expands. I’m not predicting this. I’m just bringing it to your attention. Don’t go all in with your trades until you know a new high isn’t going to be faded.

I looked at 1000 charts last night. There are some good ones out there, but most fall in the category of “high and tight.” Those are small patterns that form after big rallies. They easily break out, but getting follow through can be difficult given the already-booked gains. It will take a multi-day market rally to push these stocks out of their patterns and get them enough follow through for me to believe we won’t get a round of false moves.

Done babbling. More after the close.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers