The long term trend is up, but there are several seasoned vets who believe the party will come to an end in 2013. I’m not going to join the debate because I have found over the years predicting the market and making money are two entirely different things, and they aren’t always related.

Instead I will present a bear’s case and a bull’s case. These are THE cases, they’re just a case for each side. It’s fine to have a bias, but it’s dangerous to surround yourself with those who always agree with you, so I present both sides to help us stay somewhat agnostic to future movement. This is part 2 – a bull’s case – of a two-part series.

January was not just a good month, it was a great month – among the top 20% in the last 60 years. The January Effect says if the market is up in January, it’ll be up the following eleven months. Several decades of data confirm this, but quants have taken it a step further and learned that when the S&P gains 5% or more in January, the market doesn’t just post gains the rest of the year, the gains are typically out-sized.

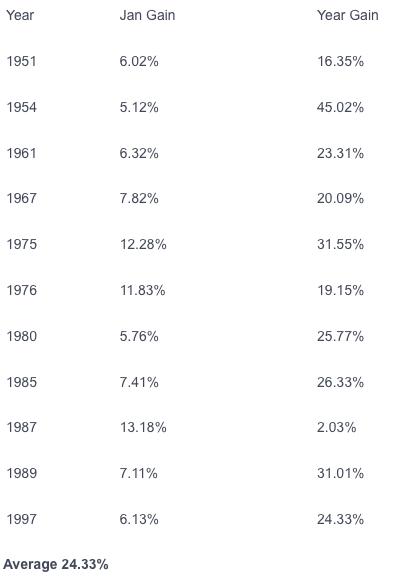

Here’s a graphic which shows how the market has done for the year in years when January posted a gain of 5% or more. Other than 1987 – the market crashed in October of that year – the market posted a double-digit gain for the year, and in all cases but two, the market posted a double digit gain on top of the January gains already realized. The average was better than 24%.

This year’s S&P gain was 5.04%. If history holds, the next eleven months will post a double digit gain on top of the January gains. Not bad.

0 thoughts on “The Bull's Case (part 2 of 2)”

Leave a Reply

You must be logged in to post a comment.

good advice neal.

hi jason i saw an interesting chart from the bonds crash of the 1930’s compared to sp500, du not sure if you can get a chart of that. but it might be history repeating itself as sp went to new high as bonds started falling then they both went higher together and finally both crashed losing about 50%.

Mac…can you send me a copy of the chart? I have no seen it.