Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up. Australia, China, New Zealand and South Korea posted the biggest gains. Japan dropped 1.8%. Europe is up across the board. Austria, France, Norway, Switzerland and London are leading the way. Futures here in the States point towards a flat open for the cash market (105 minutes before the open).

The dollar is down. Oil and copper are up. Gold and silver are flat.

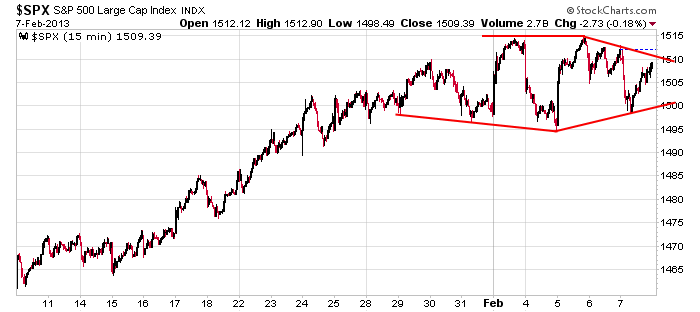

Here’s an update of the 15-min chart. Thanks to a big move up following last week’s unemployment report, we entered the week with all the indexes being at new higher highs. But a big down day Monday and a big up day Tuesday started a range whose high and low were not taken out Wednesday or Thursday. So now we have a toppy-looking diamond pattern that, if anything, suggests we’ll see an expansion in volatility soon. Also, this pattern is, more often than not, associated with tops, but I have to be honest. It’s hard picking a top in a steady uptrend. The bears have lost a lot of money over the years trying to pick tops within strong uptrends. You’re better off just managing risk than trying to be a genius and predict what will happen next. If the market moves down, there’ll be plenty of time to get short or buy inverse ETFs.

The following companies have earnings today: Moody’s (MCO), AOL (AOL), American Axle and Manufacturing (AXL), CBOE HOldings (CBOE) and Buckeye Partners (BPL).

We entered this week with hints the market needed to pullback or rest, so I was cautious. Instead of correcting with price, it has corrected with time. The indexes are more neutral now, and I’ll put the odds at 50/50 on a move up and down. The longer the range lasts, the more bullish it becomes, but at this juncture, the odds of a break down are high enough to err on the side of caution. I’m still long, but I’ll be quick to take profits should the market head south. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers