Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

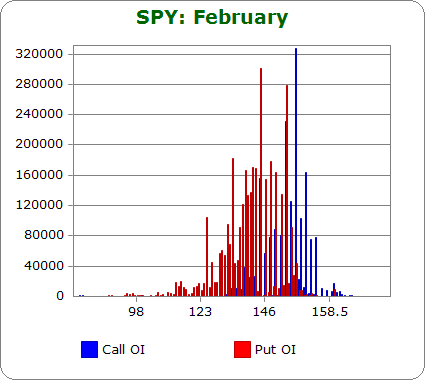

SPY (closed 152.02)

Puts out-number calls 2.0-to-1.0 – about the same as last month.

Call OI is highest at 145 and then between 150-154.

Put OI is highest at 125, 135 and between 139-150.

The overlap range is big and inconsistent. Both calls and puts have spikes at 145 and 150, and open-interest between them is steady. A close at the upper or lower side of the range would enable the “other guy” to make money. But since puts dominate, a close near the top of the range would cause more grief to the put buyers than joy to the call buyers. Today’s close was at 152.02 – above the range. A close here would cause almost all puts to expire worthless, but there will definitely be some profits for the call buyers. A move down would still expire most puts worthless and also take some profits from the bulls. That’s what’s needed for max pain.

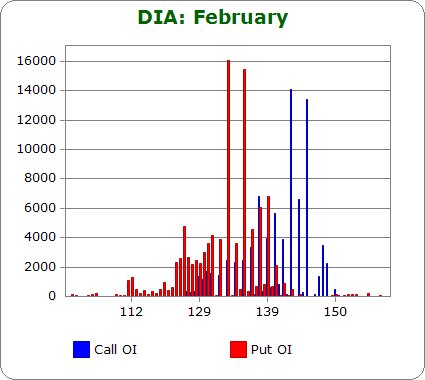

DIA (closed 140.05)

Puts out-number calls 1.1-to-1.0 – less bearish than last month.

Call OI is highest between 138 and 144; the spikes are at 142 and 144.

Put OI is highest between 134 and 139; the spikes are at 134 and 136.

DIA open-interest is so low compared to SPY that it’s hardly worth studying. Nevertheless, let’s go through the motions. There’s overlap at 138/139, so a close there would cause the most pain, mostly because the two put and call spikes would expire worthless. Today’s close was at 140.05 – slightly above the overlap range but still below the call spikes. Flat trading the rest of the week would cause the most pain, and there’s wiggle room. A slight move up or down would not change the situation.

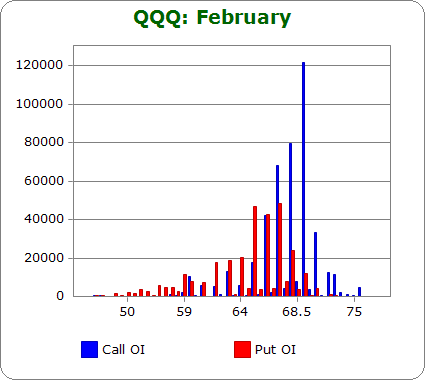

QQQ (closed 67.73)

Calls out-number puts 0.9-to-1.0 – less bearish than last month.

Call OI highest between 66 and 70; the spike is at 69.

Put OI is at 65, 66 and 67.

There’s obvious overlap at 67/68, so a close there would cause the most pain. QQQ closed at 67.73 today – slightly higher than needed but still in a decent place because the three big call spikes take place at 68 and above. Flat trading would cause a lot of pain; a slight move down would cause more.

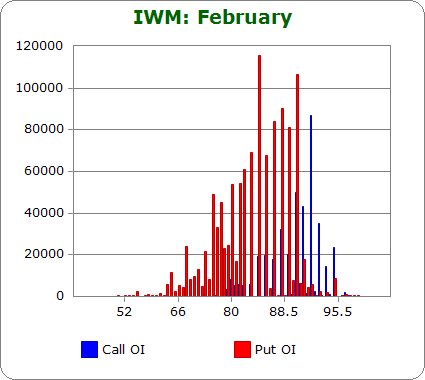

IWM (closed 91.10)

Puts out-number calls 2.9-to-1.0 – about the same as last month.

Call OI is highest between 88 and 93.

Put OI is highest between 75 and 90.

Wow, look at all that put open-interest. There’s overlap in the high 80’s, but as long as IWM closes so that most of the puts expire worthless and that big call spikes expires worthless, a lot of pain will be inflicted. Today’s close was at 91.10, which is perfect. It’s above the high put OI range and below the big call spike, which is at 92. Flat trading the rest of the week would do the trick; a slight move down would also work.

Overall Conclusion: For the most part the market is already positioned to administer a lot of pain. Most calls and puts will expire worthless or with very little value this Friday if the market trades flat. A slight move down would be fine too.