Good morning. Happy Tuesday. I’m getting a taste of 3rd world living. The power went out yesterday morning and hasn’t come back on. Unlike the States where they work ’round the clock to fix things, here, if things don’t get fixed by 5:00 when everyone goes home from work, you have to wait until the next day. lol

The Asian/Pacific markets closed mostly up. China, India, Indonesia and Japan did well. Europe is currently up across-the-board. Austria, Norway, London and Greece are leading. Futures here in the States point towards a slight up open for the cash market.

The dollar is down slightly. Oil and copper are up. Gold and silver are down.

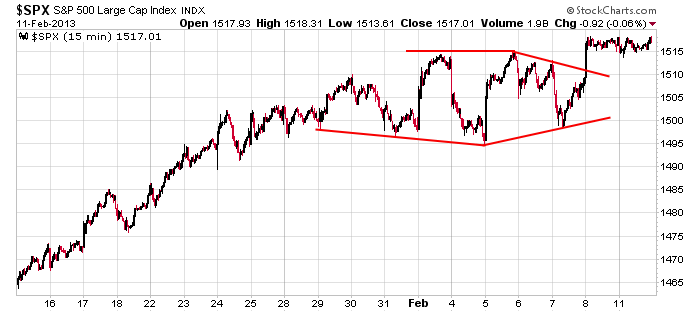

The market hit a new high Friday morning and then settled into a painfully tight range the last two days. Volume has been extremely light. I’m blaming the snow storm. There are so many market participants who haven’t showed up to work the last two days. Who can blame them?

Here’s an update of the 15-min SPX chart. The new high hasn’t gotten any follow through – it’s just sitting quietly in a small range.

I’ve been long for a long time – no reason to be anything else. When long, I’m either aggressively long or cautiously long. When I’m aggressive, I tend to give positions more time and space to move. When cautious, I have lower expectations, use tighter stops and am quicker to take all or partial profits. I’m cautious now. The market has been on a heck of a run since the November bottom. I don’t want to completely cash out because there are enough doubters out there to continue pushing prices up. But the risk/reward isn’t nearly as good as it was a two months ago, so with less “meat on the bones” my expectations are not as high. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 12)”

Leave a Reply

You must be logged in to post a comment.

Jason

is this fri ,usa feb opts ex

yesterday goldmans gave warning that its short exposure is at extreme to the retailers/pension funds long exposure and that that cant last

retailers/pension funds/investors always get caught holding the bag in the ponsi musical chairs game

mars will be invading earth anyday now

marsians eat apples so i am preparing for a nasdaq 100 crash

spx at 1522-9 resistance