Good morning. Happy Tuesday. Hope you enjoyed your extra day off.

The Asian/Pacific markets closed mixed. China and Hong Kong dropped; India and New Zealand rallied. Europe is currently mostly up. France, Germany, Amsterdam and Stockholm are posting solid gains. Futures in the States point towards a slightly up open for the cash market.

The dollar is flat. Oil and copper are down. Gold is up, silver is down.

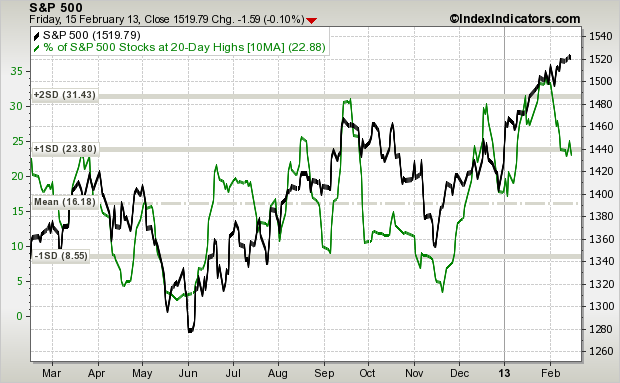

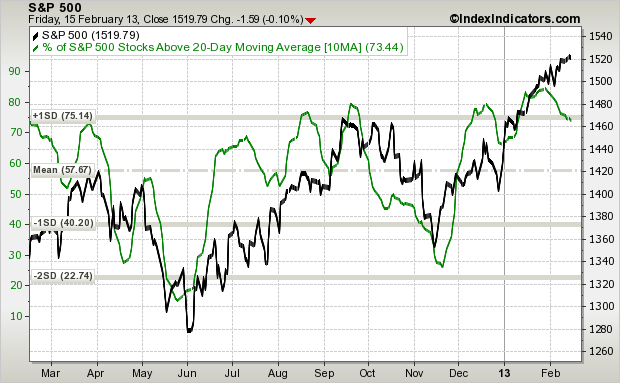

We enter this new week with the S&P on a 7-week winning streak, but volume is falling off and a couple short term indicators are suggesting some near term weakness is in order to allow the charts and indicators to reset. Specifically, the % of S&P stocks trading at a new 20-day high and the % of S&P stocks trading above their 20-day MAs has been declining for two weeks. Mathematically this can persist in the near term, but over time it’s impossible to maintain. Either the market will come down – just in the near term – or the indicators need to reverse. Here are the charts with the indicators smoothed with a 10-day MA.

But this isn’t much different than the last month. It seems there has always been a couple reasons the market should soften in the near term, but this is exactly why it hasn’t. When the market has a mind of its own, it travels the proverbial wall of worry. It travels a path to frustrate the most people. In this case, that path points up because so many traders and funds are on the sidelines waiting for a chance to get long.

Overall I still like the long side, but in the near term you gotta when when the music will stop playing. Manage positions wisely. Don’t get lazy. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers