Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. New Zealand dropped, but China, Hong Kong, Indonesia, Japan, Taiwan and South Korea all posted solid up days. Europe is currently mostly up. Belgium, Stockholm, Switzerland and Greece are performing the best. Futures here in the States point towards a flat open for the cash market.

The dollar is up. Oil is up, copper down. Gold and silver are down.

The indexes closed at new highs yesterday – an all-time high for the Russell small caps and multi-year highs for everything else. The bears keep getting spanked. They guess tops for various reasons, and they refuse to just go with the flow. Personally I’d rather jump in a move after it materializes and miss the first 10% than repeatedly guess when a top will be formed. But I’m not complaining. It’s the bears who go short and then cover or refuse to go long that are enabling this move to continue.

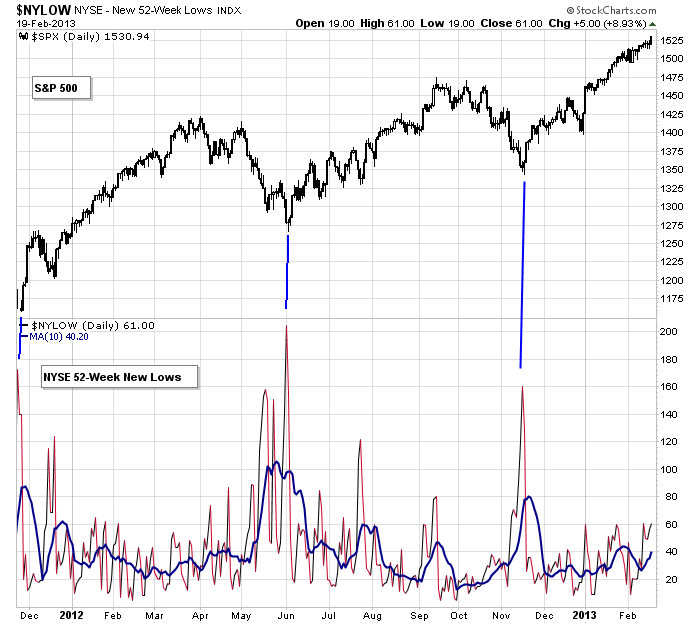

New highs have consistently printed at a high level this year. An interesting development is the potential surge in new lows. Here’s the NYSE 52-week new lows. It’s normal for there to be new lows at all times because there will always be garbage stocks that don’t deserve to be publicly traded companies, but if new lows actually start to trend up, you have to wonder what’s going on – the market trading at new highs at the same time new highs and new lows are moving up? Three times this year the curve has gotten rejected by 60. I’m not making any predictions about a breakout or what will happen if it breaks out. I’ll just simply say it’ll be an interesting development. The market has been ignoring most technical indicators, so we can’t assume it’ll suddenly start listening to this one.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 20)”

Leave a Reply

You must be logged in to post a comment.

Last Thursday and Friday my models gave sell signals. Two days in a row is not all that remarkable. My models are often a bit early as the were designed for 401K investing as opposed to trading but they are very seldom wrong.

This market is too content and happy.

Paul

as cheif CRAZY BEAR of the top pickers

i say tops have now been put in in all world markets inc euro

and a new unifyed bear will emmerge to squash the evil central banks and restore

—–LIFE ,LIBERTY AND THE CAPITALISTIC FREE MARKET—-

if this is so then then we have just seen a massive 3 wave long term corrective move and will see a fast impulsive down

if wrong then we will have a subdued corrective 4 th wave down and a new massive 5th wave up

BUT i dont have the mind set for that long term mumbo jumbo and am no good as a long term trader—to impulsive–impatent–take profits to early ect

and am more suited to my intraday thrils of schitso bull /bear piviots and the fast in/out of intraday trends

have fun be a day trader

nasdax to crash

Neal

I wrote these models in the spring of 2002. I discovered them on a floppy disk two years ago. They have been very accurate. When I filled in the data from 2003 to 2010 I was impressed.

I am measuring market data available from yahoo finance and the CBOE.

Hello Neal,

I’d love to go to your seminar. Will you pick up my costs and lunch?

Elzabeth

This is exactly the kind of dumbass cheap shot comment that will get you kicked out of here again.