Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. China and South Korea dropped; India and New Zealand rallied. Europe is currently mostly up, but only Greece (down 1.5%) has moved much from its unchanged level. Futures here in the States point towards an up open for the cash market.

The dollar is down slightly. Oil and copper are up. Gold and silver are down.

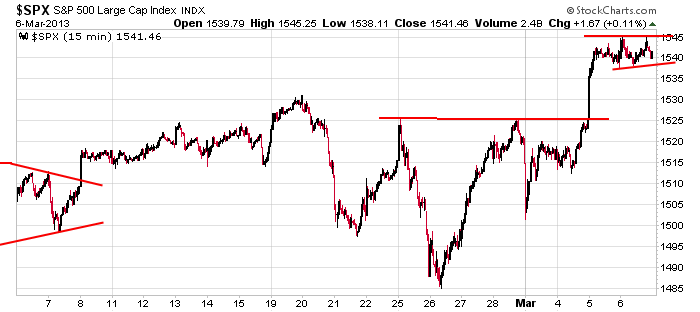

Since gapping up yesterday morning, the market has traded very quietly and in a small range. Call it a high-and-tight pattern at a new highs. Here’s a 15-min SPX chart. After two weeks of volatility and wide swings, the bulls retook control – or should I say maintained control – and the market trend continued.

Vocal analysts are very divided. Some say a top is forming and the S&P is headed back under 1000. Others say we’re in the beginning stages of a massive rally. We’re not talking about small percentage differences here; we’re talking about whether the S&P will drop to 900 or rally to 1800. But don’t worry about those who are wrong. They’ll keep their jobs…and we should be happy they do. We need people on both sides of the debate in order for Wall St. to function smoothly. When the trend is up and I’m long, I’m happy to hear the opinions of the pessimistic bears. Their ideas keep me grounded so I don’t get too one-sided in my thinking. They also represent an entire group of traders/investors who don’t believe what’s happening, so inadvertently they add fuel to the move as they throw in the towel one by one. Never get pissed off when someone disagrees with the market. Instead thank them for allowing the move to continue longer than it would have.

Today we get initial jobless claims, and tomorrow we get the latest employment numbers. Between the two, the 4-week MA of the weekly jobless claims is more important. Unlike the employment numbers which involves lots of funny math, the weekly claims is much harder to fudge and therefore more accurate.

The small and mid caps are lagging. A few indicators are lagging. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 7)”

Leave a Reply

You must be logged in to post a comment.

the talking heads and media propoganda on t.v ect is a very important key indicator

the insto banks own the media,polliticans ,judges and fed and when they want some retailers

then only bull analysts are allowed on t.v

do we have enough bull retailers –long only pension funds ect for the insto hedge funds to dump the market

are the bulls fat enough yet to eat

the ides of march quad witches could be working in the background

“Never get pissed off when someone disagrees with the market. Instead thank them for allowing the move to continue longer than it would have.”

Jason I may frame this one!LOL

Jessie Livermore always talked about removing your emotions from the market. That in part is how he was successful.

ok cobber,shes rite mate

but here is some dinky dye quotes from me

be emotional,have fun

its only a game–snakes and ladders

but always be exterior to the game

be a big boy and play the game from above

exteriorization –the art of being outside

play chess with the fed

dont get hoysted on ur own pitard

ect

in other words its 90% mind set

dragonnity of ecb played his fiddle and sprouted some propoganda today and dramaticly moved the euro today–thus the spx

i have a predicition of 1550 spx and 2820 for ndx

but dont follow my predictions—i never do