Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific markets closed mostly up. Japan rallied 2.6%; Hong Kong and India moved up more than 1%. Europe is currently mostly up. Austria, France, Czech Republic, Amsterdam and Norway are leading the way. More than two hours before the close, futures here in the States point towards a moderate gap up open for the cash market. This of course can change when the latest employment figures are released.

The dollar is up. Oil and copper are down. Gold and silver are down.

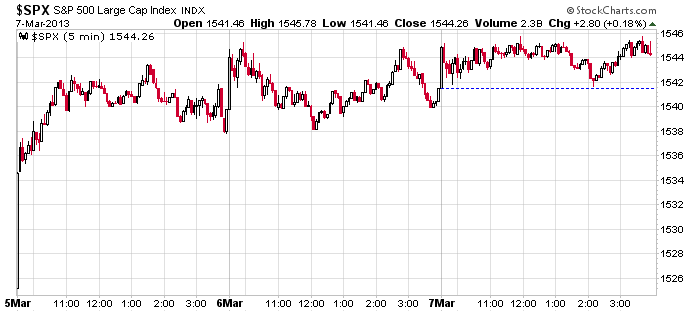

Per the 5-min S&P chart below, the market has been in a very tight range the last three days. This lulls everyone to sleep and builds energy into the market that often leads to an explosive move. Unfortunately a gap could diffuse the energy, so it’s bad timing for it to take place right now. Ideally the market would open somewhere in the range, move up and down to test the boundaries and then bust out. This would be a technical breakout. But a breakout that starts as a gap is an entirely different animal and much harder to play. Oh well. We don’t control the market, so there’s no sense complaining.

The trend is up. The Dow is at an all-time high. Most other indexes are at multi-year highs. And per my count, only the S&P 400 mid caps is slightly lagging. Whether the recent action makes sense doesn’t matter. It’s silly to fight the tape. If you’re a day trader, fine, you can try to fade intraday pops, but if you’re a swing trader, first and foremost, you want to be on the right side of the trend, and right now, that’s in the up direction. Jesse Livermore said there is no bull side or bear side, there’s only the right side. It’s like flying a kite. You don’t get to determine the direction you fly, the wind does, and it’d be silly to fight it.

I’m posting this and sending it out well before the employment data is released. I will post the numbers below when they’re released (I mostly post them because it’s easy to refer back to them; you can get the numbers in near real time from your broker or several news sites).

Here are the employment numbers…

unemployment rate: 7.7% (was 7.9% last month)

nonfarm payrolls: +236K

private payrolls:

average workweek: up 0.1 hour to 34.5 hours

hourly earnings: up 4 cents to $23.82

Have a good day. Have a good weekend. Play good defense and don’t right the trend.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 8)”

Leave a Reply

You must be logged in to post a comment.

who does control the market……….?

the ticker tape traders

does anyone know what that means

watching the world live on 4x 40 in t.v monitors,with many charts open live on 1 and 5 min

i can tell u the ticker tape trader–big insto hedgies is alive and well

buy/sell when we move price to such and such a piviot level or futures opts strike price

yes sydney is trading live atm as is japan ect

german dax hit 8000 before jobs data and a slight move over to lock in the opts strike and that will be it for the dax

japan currently trading at 12350 has pos 12500 to go

spx hit the 1550 strike

now all markets are trading lower–why –euro took a big hit on the jobs usd up

first move is always the fake out for stops–thats why it went up

to learn daytrading Neal u should take a course with ”pattern trapper”

is the aussie chick a blonde

LOL,NEAL,THE DAYTRADER

cound’nt help myself,

still ,lol

we are all cannabulls

this feels like a weekly opts fri and a set up for ides of march ,quad witch

currently have a lower double top intraday in dow as a counter trend move to opening spike

Neal,u know about those big boy retests as a daytrader