Good morning. Happy Tuesday.

First off, since moving to Costa Rica I’ve posted these before the open comments much earlier than I used to. It was entirely based on the time zone and what time my kids had to go to school. But CR doesn’t do day light savings, so now I’m back on my old Colorado schedule. So I’m back to posting approx. 30-45 min before the open.

The Asian/Pacific markets closed mostly down. China, Hong Kong, South Korea and Taiwan dropped the most. Europe is currently mixed. Only the Czech Republic (down 0.9%) has moved much. Futures here in the States point towards a slight down open for the cash market.

The dollar is up. Oil is flat, copper up. Gold and silver are up.

On an intermediate term basis, the S&P is up 15% since it’s November bottom. This is unsustainable. On a short term basis, the S&P is up 7 straight days. This too cannot continue.

The market is doing great. There will never be a time when everything you look at points in one direction, so the fact that most things point up is good enough. There will always be something lingering that causes some doubt. That’s the wall or worry that helps keep the move going. This said, a lot of easy money has been made, and as the rally continues to mature, weaker stocks will stop participating. This means we must be better stock pickers. Playing the best stocks in the best groups will always be a winning formula in an uptrend. Money will always rotate from one group to the next, so our job is to find the hot groups and play them until they fizzle. Then go play something else.

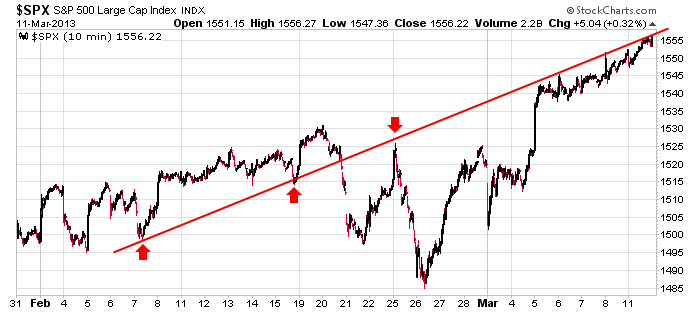

Here’s the 10-min S&P. The index is riding a trendline that was formed last month. At any time the market could crack and suffer a stiff down day, but it’ll take much more than a day or week of selling pressure to change sentiment.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 12)”

Leave a Reply

You must be logged in to post a comment.

Jason,

do u have ur quad witching opts ex report

I posted it today.

bring back the volker rule so as we can put a end to this corupt bank/central bank led 4 year

bear market counter trend rally

not all world central banks can print money like the fed

global co operation may be strained and fail

fundermentally a bear

–just to keep the bulls on their toes,so as i can scalp so more bulls—