Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

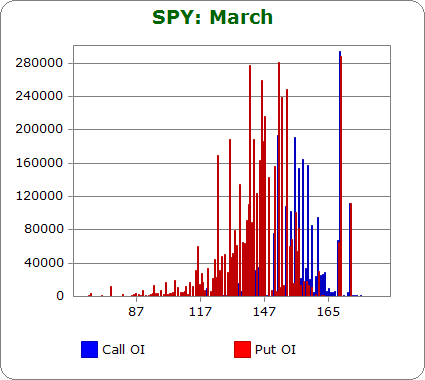

SPY (closed 155.68)

Puts out-number calls 1.9-to-1.0 – about the same as last month.

Call OI is highest between 150-157, and there’s a spike at 160, a massive spike at 170 and another big one at 175.

Put OI is highest at 125, 130, 135, between 140-152, 154, 170 and 175.

Other than the two big spikes at 170, there’s a definite block of call OI above 150 and a block of put OI below 154. This gives us an overlap range between 150-154. A close near the top of the range would close the most number of options worthless thus doing the most damage. With today’s close at 155.68, SPY is slightly above the range. This means a few of the call buyers will make some money this month. At the expense of closing more puts worthless, this is acceptable, but a slight move down would cause more pain. As far as the OI at 175, the calls will obviously expire worthless, and since SPY is near its high, anyone who bought puts is down money right now. I’d ignore the strike. I’d bet the same source is responsible for both the call and put OI.

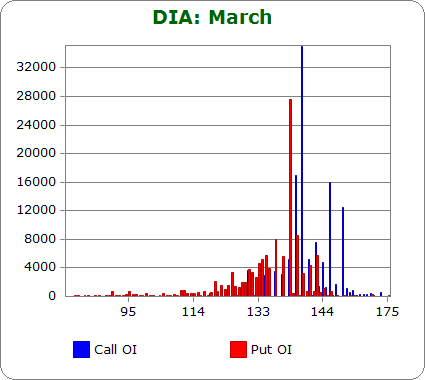

DIA (closed 144.40)

Puts out-number calls 1.1-to-1.0 – same as last month.

Call OI is highest at 140, 141, 145 and 147.

Put OI is highest between 137 and 140 with the big spike coming at 139.

The two areas meet at 139, and big spikes fall on the “right side.” A close at 139 would cause all OI at the two big spikes to close worthless, so that’s what’s needed to cause max pain. With today’s close at 144.40, DIA is way above the ideal level. A big move down is needed, otherwise some of those call buyers will make money. But, and I say this every month, analyzing DIA is useless because there’s such little volume.

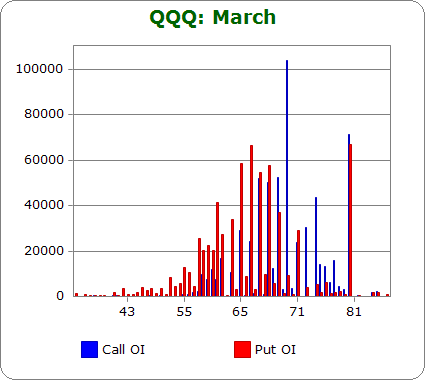

QQQ (closed 68.72)

Calls out-number puts 1.1-to-1.0 – slightly more bearish than last month.

Call OI is highest between 67-70 (big spike), at 73 and at 80.

Put OI is highest between 65 and 68, and then it tapers down in both directions. The big spike is at 80.

See my SPY comment above regarding the big spikes at 80. For everything else, there’s overlap in the 67-69 area. A close in that area would do the most damage, especially since the calls at the big spike would close worthless. With today’s close at 68.72, QQQ is already positioned to administer max pain, so flat trading is needed the rest of the week.

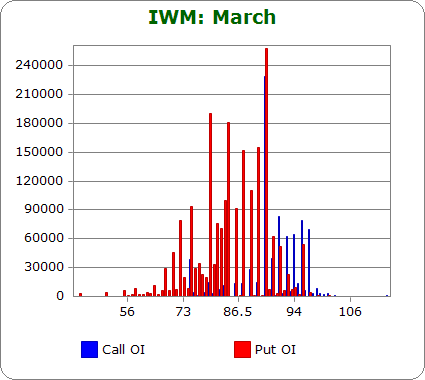

IWM (closed 93.51)

Puts out-number calls 3.0-to-1.0 – about the same as last month.

Call OI is highest at 90 (big spike) and steady between 91 and 96.

Put OI is highest at 90 (big spike) and very heavy between 80 and 89 (and a couple strikes below 80).

There’s a clear meeting of the two zones at 90 – the biggest call and put spike. That strike is also the high end of the put zone and the low end of the call zone. A close there would cause the most pain. IWM closed at 93.51 – several points above the ideal level. A move down is needed to achieve max pain. Without it, several strikes of call buyers will profit.

Overall Conclusion: There’s inconsistency with the above numbers. IWM and DIA require big moves down, SPY a moderate move down, QQQ flat trading. The two most important are SPY and IWM. Let’s just say we need a couple good days of selling to achieve max pain. Otherwise the call buyers will make some money. The put buyers seem screwed unless North Korea bombs South Korea, and the entire market collapses.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

I swear, somehow nukes in Korea will be bullish…. sad to say…

Neal

the derivitive markets control the world even china

the big boy bookmaker hedges control the retailers and thus the derivites

therefore the big boy bankers control the world

bring back the volker rule and squash the banks and the illuminasty

the fed is owned and created by the large banks

I like this monthly blog. Never ignore the put call dynamics. The behavior of puts and calls is the best indicator of the market.

Good work Jason. It is snowing like crazy up here above the 45th parallel. I am sure you have nicer weather.

Paul

I think I’d have a pretty good argument against global warming if it snowed where I’m at. 🙂