Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. Australia and Japan both rallied more than 1%; India, Malaysia and South Korea posted noticeable losses. Europe is currently mostly down, but no market is 1% moved from its unchanged level. Futures here in the States point towards a flat open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

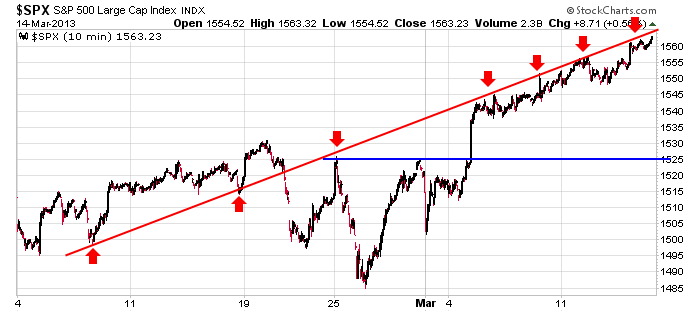

All the indexes closed at new highs yesterday. The Dow, S&P 400 mid caps, S&P 600 small caps and Russell 2000 small caps closed at all-time highs. Offering a laundry list of reasons the market is not supposed to go up will fall on deaf ears. The market is moving up. That’s the bottom line. That’s the only thing that matters. Why fight it?

Here’s the 10-min SPX chart. It continues to ride a line of demarcation that began almost six weeks ago.

Don’t over-analyze the market. Thinking too much can get you into trouble. Trading is a game where knowing a little is good, but knowing too much can be bad. With that, there’s nothing more for me to say right now. There’ll be a correction soon. Have a plan in place for how you’ll deal with it. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 15)”

Leave a Reply

You must be logged in to post a comment.

Option day often provides the volatility to change course in the market.

we may be starting a impulsive down,short term

its a retailer term Neil

means fast move–crash –sell off

but it didnt happen intraday—yet

its opposite is ”’impulsive ” dead cat

and we have had that

I always enjoy reading the commentary!

Neal

the 1 and 5 min charts with piviot points and tick indicator is never wrong

it is reality