Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Australia and Indonesia dropped 1%; India, Japan and New Zealand rallied about 1%. Europe is currently mostly up. Belgium, France, Germany, Amsterdam and Stockholm are leading the way. Futures here in the States point towards an up open for the cash market.

The dollar is up. Oil is down, copper up. Gold and silver are down.

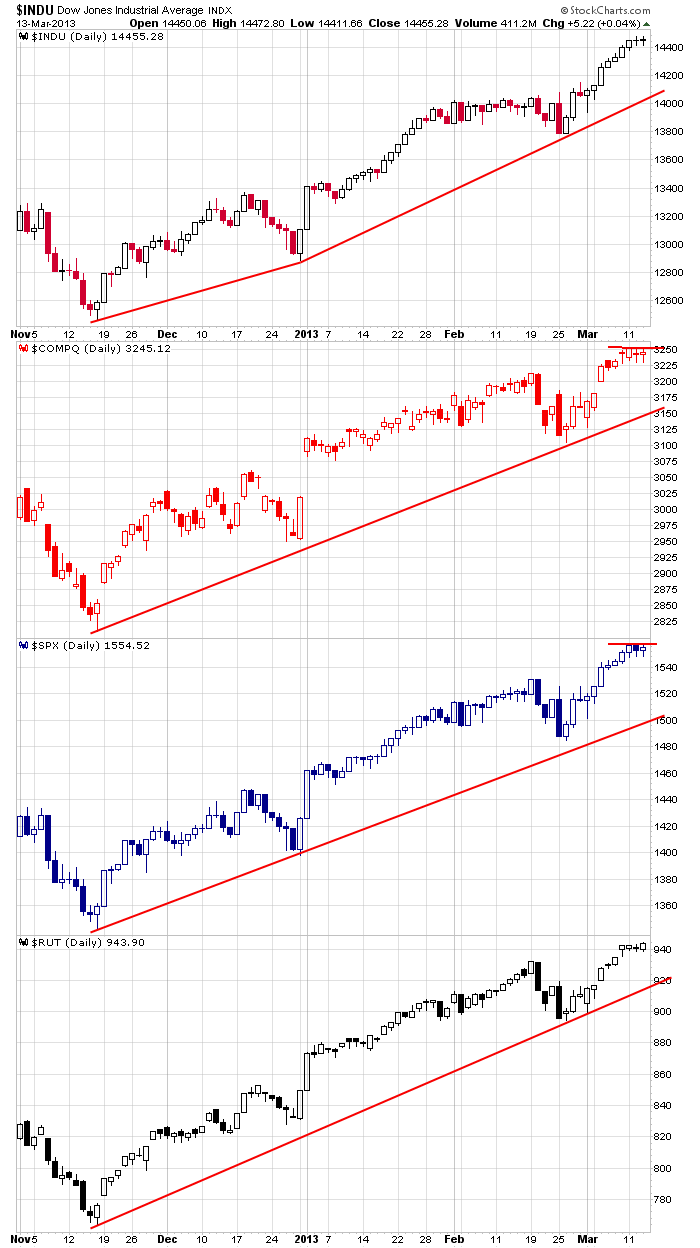

The market has traded quietly and range bound this week, so it can be said it’s correcting with time, not price. Heading into this week a little break was needed. Instead of pulling back, the market has drifted sideways. Here’s an update of the daily charts. After a solid run at the end of February/beginning of March, we now have little flag patterns forming. From a technical standpoint, these have bullish implications, and if they are forming at the midpoint of their eventual moves – as is often the case – the S&P will rally to over 1600.

Also, thanks to the recent strength, the market has a pretty nice cushion to work with. The S&P could drop 50 points and still be within its relatively steep channel (steep because it has produced a 15% SPX rally since the November low – a common move for an individual stock but not common for the entire market.

There’s only one side of the market to be on, and that’s the right side. Right now the right side is the long side. Offer any excuses you want, and they’ll fall on deaf ears. The trend is up on all time frames, and it’s silly to fight it. That’s the bottom line. Day traders can play the market in both directions because even within an uptrend, there are intraday corrections, but everyone else should be focused on the long side.

This doesn’t mean you blindly hold all positions through any pullback. Have a plan and execute. Know where your targets are. Take profits along the way. More money is made buying a new breakout than holding a stock that has already moved 20%. If you’re a permabear, let me know when you thrown in the towel and go long. That’s when a top will be in place. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 14)”

Leave a Reply

You must be logged in to post a comment.

Never will I throw in the towel, because the minute I do, the market will reverse. Better everyone else make money than I lose it.

Jason.

I went long yesterday in a day trade and made money. I have been slightly on the short side since the first of the year. Does that count?

All kidding aside statistically the markets cannot continue to go up forever.

Jason,

today may be the day

i am no longer cheif crazy bear

i am now cheif sitting bull

LOL

so we can now have a overnite key reversal

the ticker tape instos know at what price they want to sell at

but there has not been the expected rush of retailer longs to sell to