Good morning. Happy Wednesday. Happy Fed Day.

The Asian/Pacific markets closed mixed. China and Japan rallied more than 2%, Hong Kong 1%. South Korea dropped 1%. Europe is currently mixed. Austria is up 2.3%, France 1.2%. There are no big losers. Futures here in the States point towards an up open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are down.

The Fed announces their interest rate policy at 2:00 ET today, and then Bernanke has a press conference at 2:30 ET. No change in the rates is expected, but the statement will be closely read. Recently the Fed tied the raising of rates to the unemployment rate saying rates will be kept low until the employment gets below 6.5%. The Fed has a dual mandate, low unemployment and low inflation (even though econ 101 says the two are inversely related). My question for the Fed is this: What if we’re in a new normal? What if, as a result of technology in the workplace, 7% unemployment is normal and 6.5% is unrealistic other than for short bursts? Will they keep rates low forever, thereby screwing all of use who keep money in the bank?

I said yesterday Russia should just “acquire” Cyprus. It’s a small country, and a country of Russia’s size could easily absorb its debt. I was half joking and half serious. Then this morning I see the following headline: Russia May Want A Cyprus Naval Port In Exchange For A Bailout. The plot thickens. The EU plan to confiscate money from depositors bank accounts was unanimously rejected. Now Cyprus is telling the EU to screw off, they’re gonna get aid from Russia. I wonder what the EU is thinking? Are they kicking themselves? My guess is they’d rather bail out Cyprus on semi favorable terms than have Russia’s navel fleet sitting in the Mediterranean Sea.

One thing that is not on Cyprus’ side is the market’s reaction. The market in the US has moved down a small amount the last two days – no big deal. Little reaction means no one cares about Cyprus, which means Cyprus doesn’t have a strong negotiating stance.

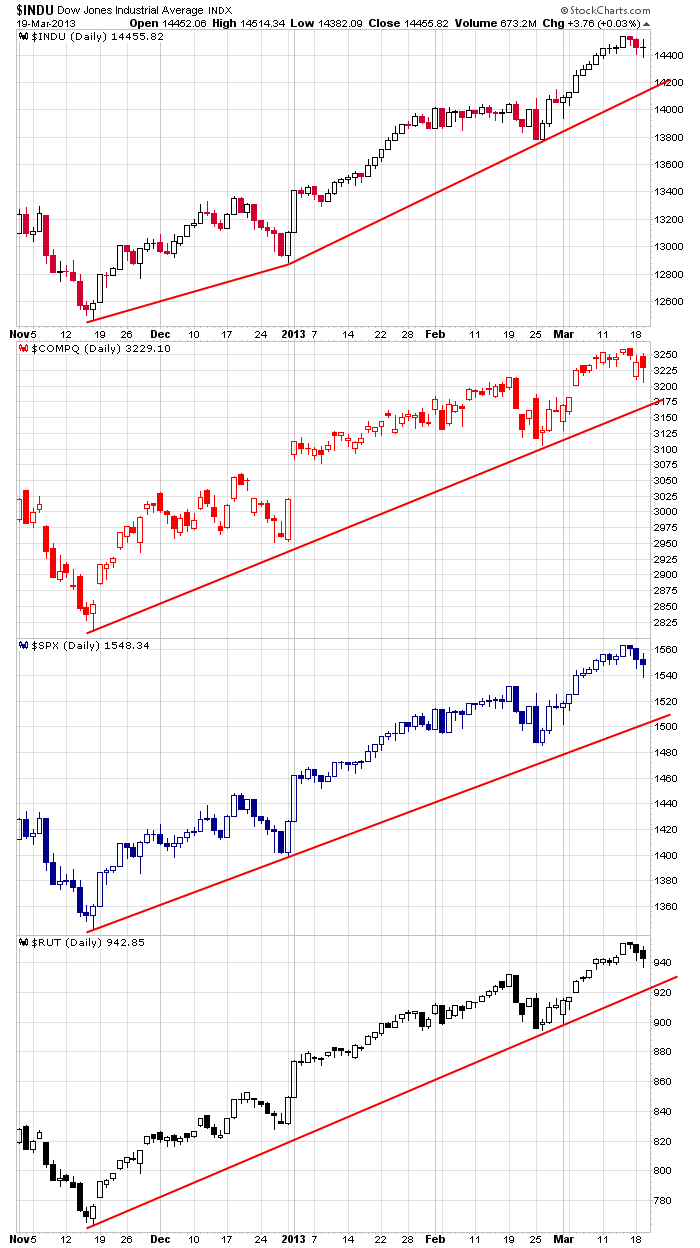

Back to the market…here are the daily charts. I’d like to see a minor correction or at least another week of sideways movement before the market attempts to move higher.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 20)”

Leave a Reply

You must be logged in to post a comment.

I hear Turkey is disputing some of the gas claims of Cypres. hmmmmm… just one for the back pocket of the mind to keep an eye on…