Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed and with a bearish slant. Japan rallied 1.3%; no other index moved 1%. Europe is currently mostly down. Austria is up 1%; France, Germany, Amsterdam, Switzerland and London are down. Futures here in the States are flat.

The dollar is flat. Oil is down, copper up. Gold and silver are up slightly.

Things are heating up in Cyprus. The ECB has given the country four days to reach a bailout deal with someone or else it’ll pull the ELA (emergency liquidity assistance). This of course comes after Cyprus unanimously rejected a deal that involved a one-time tax on bank deposits. Cyprus is talking to many sources and is said to be considering nationalizing the pension funds of semi-state owned companies. And to top it off, banks in Cyprus have been closed. The entire system has been shut down.

Whatever happens with Cyprus doesn’t seem to be a big concern to the US. The S&P initially took a hit, but the losses have been recovered and the index is within 5 points of its high.

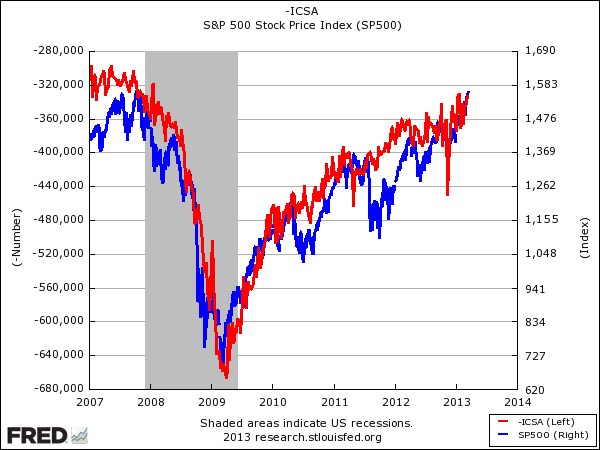

Initial jobless claims are out. It’s been shown the 4-week MA of the data is much better tell for the economy than the monthly unemployment rate. The chart below compares the S&P 500 (blue) and the initial jobless claims (red) (note the red line has been flipped upside down so we can get a better visual). The conclusion is simple and obvious. When initial jobless claims drop, the market moves up. The relationship is not perfect, but it’s close enough to warrant paying attention to the weekly number.

The last five jobless claims numbers are: 366K, 347K, 342K, 332K, 336K (today’s number). The 4-week MA dropped to 339,750 – the lowest level since Feb 2008. Nice trend.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers