Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. Australia, China and Japan dropped; Indonesia, Malaysia and Singapore rallied. Europe is currently mixed. Belgium and Czech Republic are down; there are no big winners. Futures here in the States point towards a positive open for the cash market.

The dollar is up slightly. Oil and copper are up. Gold and silver are down.

News from Cyprus is that banks will remain closed until Thursday so policymakers have more time to implement capital controls. The fear is even people who have less than 100K euro will withdraw their money, so a bank run will play out.

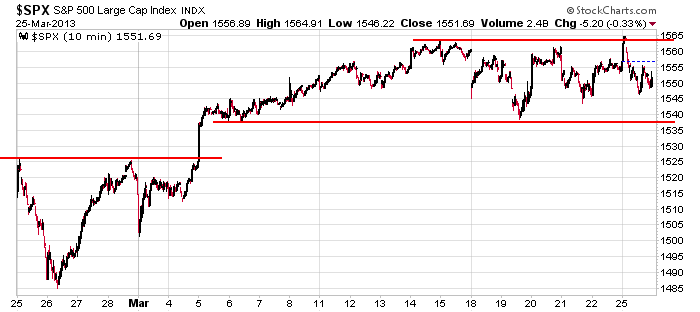

The market’s range that’s been in place since the first week of March remains in place. Rallies and gap ups get sold, dips and gap downs get bought. The trading environment has been good but not great. Many of our set ups have worked well; a few have fizzled out.

I’d like to think a trending move is coming, but with the market closed Friday and a likely slow day Thursday, I’m not sure there’s time or interest in pushing the market directionally. It could still happen. Trends at the end of December are not uncommon, so I’m wondering what the invisible hand of the market wants heading into a holiday.

Don’t think too much. Don’t over-analyze. The long term trend is up. The intermediate term trend is up. The short term trend is neutral. I believe one of two scenarios will play out. 1) The market will bust out and rally from the current consolidation pattern. 2) The market will break down and shake out some of the weak longs; then it will rally. A third scenario would be a false breakout to the upside followed by #2. In all cases I think the market will move up, and the S&P will make new highs. If I’m wrong, if the market breaks down and never makes a new high, oh well. One of the consequences of riding a trend for all it’s worth is you lose a little money when the trend ends. I’d rather lose money when the trend ends than repeatedly lose by guessing tops all the way up. More after the close.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 26)”

Leave a Reply

You must be logged in to post a comment.

This rally is just a little long in the tooth. Bulls are too happy. I have not liked this market this year at all.

Tops are very hard to pick. I am glad Jason agrees.

I do see more signs of a top the Russel has been lagging the NASDAQ. Never a good time to go long.