Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. China dropped 1.1%; Australia, Indonesia, Malaysia and New Zealand rallied 0.8% or more. Europe is currently down across-the-board. Greece is down 4%, France 2% and Belgium, Germany, Amsterdam, Spain, Italy and the Czech Republic more than 1%. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

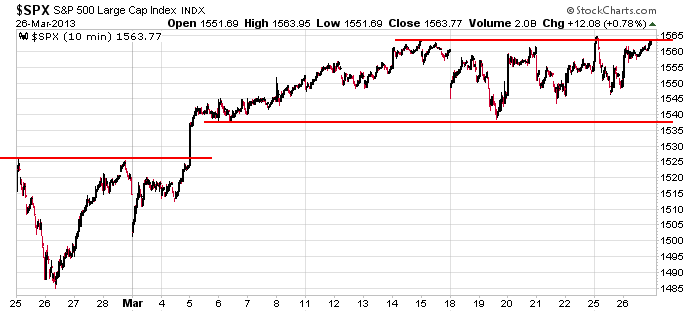

Yesterday the market gapped up, traded range bound and then rallied into the close. It was a good day, but it lacked enthusiasm. Here’s the 10-min SPX chart. The range continues. The market trends, the market chops. Unfortunately for us traders who want movement, it spends more time chopping than trending. That’s just the way it goes. Trading is and always will be a “take what the market gives you” endeavor. It’s like sports. The type of swing you take when the pitcher throws you a belt-high fastball is different than when he throws you curve at your knees. As the market changes from one personality to another, we must make slight adjustments.

Although the S&P closed near the top of its range, it’ll take a pretty good up day to bust out today because as of now, the indexes will gap down about 8 points at today’s open.

The market is closed Friday, so tomorrow is likely to be dead. That doesn’t leave much time for a convincing move.

Cypriot central bank chief Panicos Demetriades says upwards of 40 percent of uninsured deposits at the Bank of Cyprus could be lost, and 80 percent of uninsured deposits at Laiki could be wiped out. Amazing.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 27)”

Leave a Reply

You must be logged in to post a comment.

quote “Cypriot central bank chief Panicos Demetriades says upwards of 40 percent of uninsured deposits at the Bank of Cyprus could be lost, and 80 percent of uninsured deposits at Laiki could be wiped out. Amazing.”

Who nominated person with SUCH name for Head of Central Bank position??? What they expected him to do?

Come on Neal – please give us all a break from your gloating self centered know it all comments.

To me you seem to run with the hares and hunt with the hounds.

Everyone trades different time frames and in different manners/styles. It does not make them right or wrong nor do they deserve to be the objects of your superior denigration.

At the risk of offending Jason whose work is sensational – Just stop being a SA Neal.

With my utmost respect to Jason – if you don’t like my post Jason then please feel free to delete it. At least if you do I will know it was your choice.

Furthermore Neal – if you feel you MUST reply then pay me the courtesy of referring to me by my correct name rather than the insulting abbreviation of “LIZ” you have previously used.

ELIZABETH

Elizabeth,

It’s not in Neal’s DNA to be humble. I can/will predict the market will be higher in two years from now and have a 50-50 chance of being right.

Stay cool and good trading,

Wayne

Elizabeth,

Bravo!

Neal, your trader code-speak is getting really annoying and surely doesn’t help us in the marketplace. It does appear to stroke your ego, but you could just as well post these comments on your own site so your ardent admirers could layer on their praise. As for me, (and “Liz”), your educated commentary is welcome but leave your ego at the doorstep. Thanks for the pointer on IBM; I got called out last month and need to check it now.

this all feels like a long distribution to me—2 weeks

weather we get a fast pop above current to take out short stops and give us a false break is probably inmaterial

what is important is ,are the big boys ready

my alter ego –cheif crazy bear says go the bears eat fat bulls

neal,you are being naughty again

Elizabeth is a real nice person and a good trader

now please behave ,neal

or i will get Howards dogs onto u