Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. Hong Kong dropped 2.7% and South Korea 1.6%. Japan rallied 1.6%. Europe is currently mostly down. Austria is up 1%. France, Germany, Amsterdam, Norway, Stockholm, Switzerland and London are down more than 1%. Futures here in the States point towards a big gap down for the cash market, but this is likely to change after the unemployment numbers are released.

The dollar is flat. Oil and copper are down. Gold and silver are up.

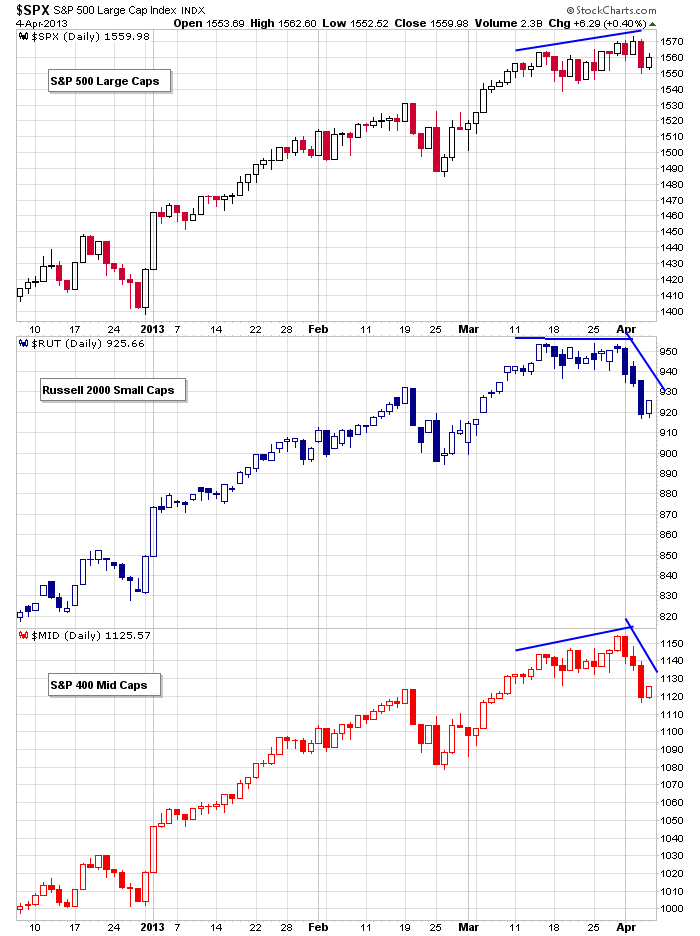

So far this week we’ve had two up days, and the net for the S&P is down 0.6% – not very much damage but still the biggest weekly drop this year. We’ve had two other corrections since the November bottom – neither lasted very long or dropped very far. If there was a difference, this one carries the stigma of the small and mid caps underperforming. Here’s a 4-month chart comparing the indexes.

This is my #1 indicator. The market will not recover its recent losses until the small and mid caps firm.

Here are the employment numbers…

unemployment rate: 7.6% (was 7.7% last month)

nonfarm payrolls: +88K (the smallest gain in 10 months)

private payrolls:

average workweek: up 0.1 to 34.6 hours

hourly wages: up 1 cent to $23.82

January and February numbers were revised up.

On the news, futures sold off hard. S&P futures are now down almost 20. Yikes. This will open the market near its lowest level since early March. No biggie. We’ve been in a defensive posture all week. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 5)”

Leave a Reply

You must be logged in to post a comment.

“This is my #1 indicator. The market will not recover its recent losses until the small and mid caps firm.”

Agree but how long will it take?

The NFP shows the lowest participation rate in the work force in decades. Yet, housing is supposed by many to be the savior of the economy. No jobs, no housing. The current housing move is based on builder financing which is glued together with nonbank loans, most short term loans that must roll in 5-7 years. A setup for a knock down. Bubble?

We must suspect that Obama care is having its impact, employers are cutting back hours and numbers of employees, and continue to do so to remain competitive. The new cost of core employees will rise 5-8% this next year; no change in sight. The President’s policies are one of the problems, and current tax rates are the second which Congress must fix. The way out is not clear to anyone. I am short for a while.

Poor Neal needs some meds. Signs of this impending roll over were ubiquitous and have been developing for weeks. Like an avalanche, it just needed a trigger and yes I have been short for a week now. 😉

i have rescued my dead cats –gruesome and awesome,from neals modleing agency

they are now prepareing for their next engagement

i will pay them with euros below 1.26

Sorry Neal – only non egocentric people can learn the hula. It is too free flowing for those who lack flexibility.

Sorry I can’t meet you in Denver this weekend but I’m in Australia. I’ve been to Denver about 25 times and really it still does nothing for me.

In your 7.59am post I might point out the correct use of “there” in the 3rd last line is “their”. You may wish to take a crash course in the English language and bone up on your grammar.

Hi Neal, I have a PhD, in a field a bit more demanding than economics. It requires logic, mathematics, and thinking, and most of all, my field has no interest in ripping off anyone. Care to guess? Come on big guy, show me what you got!

Yey Tom – go you good thing LOL YES YES YES